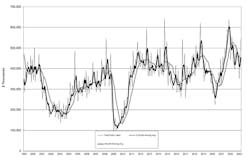

Machine Tools Orders Slipping Behind 2022 Rate

Machine shops and other manufacturers’ new orders for machine tools rose to $543.2 million during March, up 16.5% from February but still -1.8% less than the March 2022 new-order volume. The three-month total for new orders was $1.26 million, or -7.5% less than the January-March 2022 total.

The figures are reported by AMT – the Association for Manufacturing Technology in the latest U.S. Manufacturing Technology Orders Report, a monthly summary of nationwide and regional demand for metal-cutting and metal-forming and -fabricating machinery. The USMTO offers a forward-looking indicator of overall manufacturing activity, as machine shops and other manufacturers make capital investments in preparation for demand expected in the weeks and months ahead.

“Based on historical trends, we expected March to be an improvement over February,” commented AMT president Douglas K. Woods, president of AMT. “In an upside surprise, March 2023 is the first month of orders of over half a billion dollars since IMTS (2022) and one of the largest March totals since 2008. “While most industries we track increased orders in March 2023, several were particularly boosted, as they were the beneficiaries of last year’s infrastructure and chips bills that have begun to be implemented,” Woods detailed.

He added: “Despite the optimistic tone of March orders, there are several headwinds that could result in a summer cooling for the manufacturing technology industry… Although many economists have been predicting a recession for months, the general thinking now points to a slowdown toward the end of the summer or early fall.”AMT isolated several points within the March data that suggest momentum in some areas of manufacturing. For example:

- Construction machinery manufacturers ordered the most machines in a single month since April 2008.

- Contract machine shops “nearly doubled their orders from February,” and placed the highest number of orders since IMTS in September 2022.

- Aerospace shops placed their highest volume of orders for 2023.

- Manufacturers of motor vehicle transmissions booked their highest volume of orders since June 2022.

“Investments made by automakers show the need for additional internal combustion engine manufacturing capacity as a bridge during the transition to electric vehicles,” according to Woods.

The regional results in the March 2023 USMTO report also show some notable areas of strength. In the Southeast, AMT recorded new orders of $70.77 million for metal-cutting machines, a 98.1% increase from February, though this figure is -9.3% lower than the March 2022 figure.

In the North Central-East region, new orders for metal-cutting machines dropped -21.8% from February to $142.6 million, but that represents a 27.1% improvement over March 2022.

The North Central-East (20.6%), Northeast (4.9%), and North Central-West (1.7%) were the only regions in which metal-cutting machine orders showed a year-to-date increase for the January-March period.

“Anecdotally, we have been hearing that quotation activity has already begun to slow, and given the typical sales cycle, that could translate into some softness in manufacturing technology orders later this year, in line with the economic predictions,” according to AMT’s Woods.