US Machine Tool Demand Dropped 6.0% in 2022

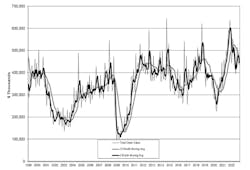

U.S. manufacturers ordered $434.1 million worth of new machine tools during December 2022, nearly -2.0% less than the November result and -26.9% less than the December 2021 total. The full-year total value for new orders was $5.54 billion, a decrease of -6.0% from the 12-month value reported for 2021.

“For yet another month in 2022, and now for the whole year, we can report that while orders were down, the manufacturing technology industry is doing great,” stated Patrick W. McGibbon, chief knowledge officer at AMT – the Assn. for Manufacturing Technology. “The industry recorded its third-best year in 2022. Despite the reduction in orders from 2021, it is hard to find a negative story about the manufacturing technology industry.”

AMT reports values for new orders in its U.S. Manufacturing Technology Orders report. USMTO summarizes monthly totals of nationwide and regional demand for metal-cutting and metal-forming and -fabricating machinery. It is a forward-looking indicator of overall manufacturing activity, as machine shops and other manufacturers make capital investments in preparation for demand expected in the weeks and months ahead.

According to AMT, continuing demand for new machine tools was critical to the 2022 results. Machine shops supplied the largest share of new orders for the year, though that market share decreased versus the previous year. Agriculture-equipment manufacturers' orders also decreased year-over-year, while aerospace manufacturers' orders rose over the 2021 total.

“Of the 27 customer industries tracked by USMTO, the number who are underperforming 2019 could almost be counted on a single hand,” said McGibbon. “Over the last two years, we have been pointing out potential hurdles that could upend the historic run of order activity. Each time, the industry responded by taking in more orders than expected, which is a testament to the health of the United States manufacturing sector and a great way to begin 2023.”The regional results for new orders showed only one territory – the South Central – finishing 2022 with a positive result. Buyers in that region booked $488.44 million worth of new metal-cutting and -forming/fabricating equipment, a 9.6% year-over-year improvement.

The Southeast region came close to a positive result for the year, with $738.82 million worth of orders falling just -0.3% off the 2021 pace.

The West region ($1.043.8 billion in new orders) slipped -3.8% for the year; the North Central-West ($1.338.2 billion) was down -5.9%; and the Northeast region ($914.5 million) dropped -8.5% off the previous year’s total.

The North Central-West region drew $1.019.23 billion in new orders last year, -15.3% less than the comparable total from 2021.