U.S. Machine Tool Orders Accelerate in Q1

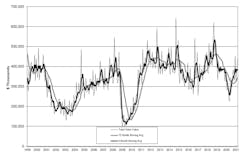

Machine shops and other manufacturers placed orders for new capital equipment worth $437.9 million during March, the second consecutive month of rising demand for metal-cutting and metal-forming and -fabricating equipment, according to the U.S. Manufacturing Technology Orders report published by AMT – the Assn. for Manufacturing Technology. The March total is 16.1% higher than the February result and 37.5% higher than March 2020.

Through the first three months of this year, new orders for manufacturing technology total $1.14 billion, which is 30.0% higher than the January-March 2020 total.

“It is noteworthy that total orders in the first quarter were significantly higher than total orders in Q1 2020, given the strength of the first three months of 2020, when the pandemic had not yet affected the industry,” stated AMT president Douglas K. Woods. “And while these are certainly impressive numbers, they should have been even higher when looking at Oxford Economics’ prediction that U.S. GDP could have been 9.2% had inventories been at their normal levels, versus the 6.4% actually achieved for Q1 2021.The USMTO report is a forward-looking index to manufacturing activity, tracking manufacturers’ capital investments in anticipation of future work orders. It incorporates actual figures for new orders of metal-cutting and metal-forming and -fabricating equipment, nationwide and in six geographic sectors, based on information supplied by participating producers and distributors of that equipment.

Woods commented that several industrial sectors showed particular strength during March 2021, including agricultural, construction, and mining machinery – orders for which more than doubled from February, as well as recreational equipment (boats, motorcycles, snow mobiles, and ATVs.)

“Two notable industries which saw declines over February 2021 were automotive and aerospace, two sectors which typically drive manufacturing growth, highlighting just how strong orders from other sectors were in March,” Woods said.

The Northeast and South Central regions turned in the best results in the USMTO report’s regional totals for March. New orders for metal-cutting equipment rose to $73.76 million in the Northeast, up 45.4% from the region’s February result and up 66.0% from the March 2020 total. The South Central region’s March new-order volume for metal-cutting equipment rose to $30.34%, up 50.2% from February and up 87.7% from March 2020.

The West and North Central-West also scored improved new-order totals for March. In the West, new orders for metal-cutting equipment rose to $77.48 million, up 23.2% from February and up 38.8% from March 2020. In the North Central-West, the region’s new orders totaled $89.9 million, which is up 21.7% from February and up 85.9% from March 2020.

New orders for metal-cutting equipment were flat in the North Central-East region, at $120.55 million showing no change from February, though still 37.2% higher than the March 2020 order total. And, in the Southeast region new orders fell -16.0% from February to $28.74 million, which also marked a -46.2% decrease in orders from March 2020.