Machine Tool Orders Up 12% Over 2020

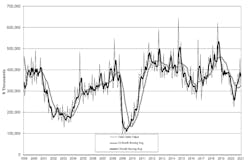

U.S. machine shops and other manufacturers ordered new capital equipment worth $322.5 million during January, a -28.9% drop from the December order volume in the U.S. Manufacturing Technology Orders report issued by AMT – the Assn. for Manufacturing Technology. However, the new figure is 11.6% higher than the January 2020 total, supporting the case that a manufacturing recovery is in progress.

“It is encouraging to see that January was the third straight month of year-over-year gains in manufacturing technology orders,” stated AMT president Douglas K. Woods. “The decline from December 2020 was expected, given the unusual strength of that month’s orders. January orders were buoyed by the largest capital equipment investments in forming technology since May 2019.”

AMT’s USMTO report is a forward-looking index to manufacturing activity, tracking manufacturers’ capital investments in anticipation of future work orders. It contains actual figures for new orders of metal-cutting and metal-forming and -fabricating equipment, nationwide and in six geographic sectors, based on information supplied by participating producers and distributors of that equipment.

Significant increases were reported for metal-forming/fabricating orders, up +161.5% year-over-year nationwide, with even more remarkable increases in the North Central-East (+392.1% year/year) and West (+111.1%) regions.

“The automotive sector was particularly active, as U.S. auto manufacturers are planning external body styling changes in 2021 that were postponed in 2020 due to the pandemic,” according to Woods. “The high number of January automotive orders for forming not only reflected orders planned for 2021, but also included orders planned for 2020 that were delayed until 2021.”

Woods also identified strong order volumes from mold-and-die manufacturers, which he indicated has been adding production capacity steadily since May 2020. He attributed that trend to “supply chain shifts to domestic producers.”