Machine Tool Orders Recovery is Building

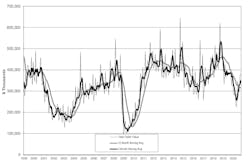

U.S. machine shops and other manufacturers ordered $383.8 million worth of new capital equipment during October, 3.7% more than their September order total and just -0.6% less than the October 2019 total, according to data reported by AMT – the Assn. for Manufacturing Technology in its latest U.S. Manufacturing Technology Orders report. While the number of machine units declined from September, October marked the second consecutive month for rising order values -- a total that was the highest value reported for any month since December 2019, according to AMT.

“All metrics point to a continuation of economic recovery in the manufacturing technology sector,” stated Douglas K. Woods, president of AMT. “Industrial machinery orders were strong in many industries relative to this time last year. The mold-and-die sector experienced strong growth for the second straight month, with orders being multiples of typical numbers and strongly indicating that mold and die manufacturing is being reshored.”

AMT’s USMTO report is a forward-looking index to manufacturing activity, tracking manufacturers’ capital investments in anticipation of future work orders. It contains actual figures for new orders of metal-cutting and metal-forming and -fabricating equipment, nationwide and in six geographic sectors, based on information supplied by participating producers and distributors of that equipment.

While machine tool new orders had been weakening during the latter months of 2019, a recovery had been forecast for late 2020, prior to the onset of the COVID-19 pandemic.

“Pandemic-related needs for secure supplies of medical equipment, as well as continued strong growth for consumer products such as appliances, also contributed to this growth,” Woods continued. “Consumer products grew due to a continued strong housing market; housing starts in the last two months have been the higher than any time since 2007.”

Woods also noted indicators of strong machine-tool demand for operations serving the automotive and rail sectors.

“Unfortunately, the news is still not promising in the lagging aerospace and oil-and-gas sectors, as these sectors are still experiencing weak growth, and we do not foresee any significant uptick in growth in either sector in the foreseeable future,” he noted.

Regional demand for new machine tools was strongest in the North Central-East ($116.2 million for new metal-cutting machinery, +46.8% versus September, +10.2% versus October 2019); and Northeast ($68.7 million, +14.7% / -3.3%.)

Weak results were reported for the North Central-West ($66.43 million, -7.5% / +7.1%); West ($60.6 million, -16.4% / -13.5%); Southeast ($43.96 million, -10.3% / -7.5%); and South Central ($20.3 million, -11.5% / -10.0%.)