Machine Tool Orders Show Market is "Stabilizing"

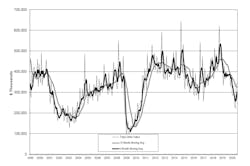

Domestic machine shops and other manufacturers booked orders for 1,847 new machining centers during July, a total valued at $337.5 million. It represents a -1.7% decrease in orders value from June, and a -13.8% drop from the July 2019 value. Through the first seven months of 2020, U.S. manufacturers' machine tool orders are valued at $2.02 billion, a -24.7% drop from the January-July 2019 value.

“The manufacturing technology industry seems to be stabilizing, and order growth is more balanced across sectors,” stated AMT president Douglas K. Woods. “We see this as well in YTD growth numbers, which experienced a lower rate of decline in July.

The data is supplied by AMT – the Assn. for Manufacturing Technology in its monthly U.S. Manufacturing Technology Orders report, which is a forward-looking index to manufacturing activity, tracking manufacturers capital investments in anticipation of future work orders. The USMTO presents new actual figures for orders of metal-cutting and metal-forming and -fabricating equipment, nationwide and in six geographic sectors. It is based on information supplied by participating producers and distributors of that equipment.

The volume of new orders was significantly undercut by the closures undertaken to stop the spread of the Covid-19 pandemic, which has forestalled recovery from a preceding decline in machine tool demand.

The AMT president cited three months of "steady increases" in capacity utilization, together with stable recovery in the Institute for Supply Management's Purchasing Managers Index, as a sign that " the bottom of the downturn may be near."

Regional results in the July USMTO report show positive activity in two sectors of the country: new orders for metal-cutting equipment rose 7.6% to $49.8 million in the Southeast region, which was a 60.1% year-over-year improvement. It moved the Southeast regional YTD total for new machine orders to $299.7 million, or -1.7% lower than the January-July 2019 result.

Even better was the July total for metal-cutting machines in the North Central-East region, which were valued at $117.0 million, 68.2% ahead of June and 10.6% ahead of July 2019. The region's year-to-date total stands at $493.76 million, -20.1% behind the seven-month total for last year.

Each of the other four regions (Northeast, North Central-West, South Central, and West) reported double-digit declines in new orders for metal-cutting machines from June to July, as well as year-over-year and year-to-date.