EU Machine Tool Orders May Be Recovering

European machine-tool builders are enduring a significant decline in demand due to the Covid-19 pandemic and the consequent idling of industrial activity, though trade associations for two of the region's largest machine-tool industries point to indicators that a recovery process has begun. VDW, the German Machine Tool Builders' Assn., reported new orders for 2Q 2020 fell -46% from 2Q 2019; while UCIMU, the trade association for Italian machine-tool builders, posted -39.1% fall in orders over 2Q 2019.

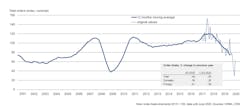

For comparison, the U.S. Manufacturing Technology Orders report issued by AMT – the Assn. for Manufacturing Technology recently reported 2020 year-to-date new orders totaled $1.69 billion through June 2020, -26% lower than for January-June 2019. (AMT reports orders monthly, rather than quarterly.)

"The second-quarter figures clearly show the impact of the Corona lockdown," according to Dr. Wilfried Schäfer, executive director of VDW. "Many customer sectors, especially the aviation and automotive industries, are experiencing sharp declines in sales. … It is encouraging to note, however, that the downturn in the level of orders received now appears to have bottomed out. In June, there was a noticeable increase compared with the two previous months."

German, Italian, and all European machine-tool builders are heavily reliant on exports for their products, especially from North American and Asian manufacturers.

VDW noted that Purchase Managers Index (PMI) for July increased in July in China, the U.S., and the E.U. (including in Germany, France, and Italy) for the first time since the pandemic began. The association also cited Germany's Ifo Business Climate Index to note that German manufacturers' capital spending rose during July, with recovery evident in retail sales and increases in industrial production and exports beginning in June.

However, manufacturing activity had already been slower than the previous year's rate as the pandemic began, and factors like retail spending and industrial investment may take longer to "filter through to the machine tool industry, which is a late-cycle capital goods sector," VDW explained. "Accordingly, the industry's expectations for the coming six months remain subdued. The latest sales figures support this view. Sales in the first half of the year were -26% down on the previous year."

The group identified industrial investments driven by digitalization and 5G expansion, investments by medical technology and electronics manufacturers, and suppliers of parts for the mechanical engineering sector, as being in a "slightly stronger position."

UCIMU reported its members' overall drop (-39.1% year/year) in orders was the result of a -44.7% decline in domestic orders and a -37.8% drop in orders for exports.

“In the month of April," according to UCIMU president Massimo Carboniero, "the machine-tool manufacturing enterprises, as well as a good part of their customers, remained closed, stopping both their production and trade activities. All this has strongly affected the overall performance of the quarter, which shows a difficult situation for the operators of the manufacturing industry.

“The uncertainty generated by the pandemic and its asynchronous spread in the different areas of the world," he continued, "complicates matters and undoubtedly slows down investments in production systems, but we, the Italian manufacturers, are receiving some small signs of recovery, especially from the domestic market.”

He offered UCIMU data based on an econometric survey by the Oxford Institute of Economics to show that in 2021 investments in new production technologies should rise again. "The demand for new machine tools in Italy is thus expected to grow by 31.5% versus 2020, exceeding €3.5 billion ($4.13 billion.) "Even Europe should be more dynamic," Carboniero continued, "increasing consumption by 19.5% to nearly €18 billion ($21.22 billion.) Asia, with China in front, should have new impetus, registering a 35.3% demand growth, corresponding to €34 billion ($36.55 billion); and so should America, expected to invest €11 billion ($12.97 billion) in new production systems, i.e. 31% more than in 2020.

Carboniero expressed hope that the worst effects of the pandemic have subsided, and that expectations for an expected recovery will be realized in 2021.