June U.S. Machine Tool Orders Rose 56%

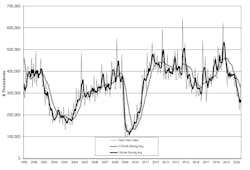

Machine shops and other manufacturers increased their machine-tool orders to $346.7 million in June, up 55.7% from May but still -6.5% lower than the June 2019 total. “Given the level of uncertainty businesses are facing, the strong June orders are a sign of the underlying health of the manufacturing sector,” stated Douglas K. Woods, president of AMT – the Association for Manufacturing Technology, which issues the monthly U.S. Manufacturing Technology Orders report, from which the data is drawn.

“While promising in the current climate, June orders were still about 9% lower than the monthly average of 2019," Woods continued. "The signals point to the current downturn not being as deep as initially expected; however, the duration of the downturn remains an open question."

The extraordinary pause in business activity during Q2 2020, the result of the COVID-19 pandemic, came in the midst of a manufacturing downturn that had seen machine tool ("manufacturing technology") orders weakening for much of the past year. For the current year to-date, the USMTO shows new orders total $1.688 billion, or -26.4% versus January-June 2019.

“It appears that the industries focused on end-use products bucked broader economic trends and increased capacity," he noted, "while industries farther up the supply chain followed the general tide. It is only a matter of time before sectors farther up the supply chain will need to increase their capacity as inventories deplete and demand increases for component parts."

The USMTO report tracks orders for metal-cutting and metal-forming and -fabricating equipment, nationwide and in six geographic sectors. It is based on information supplied by participating producers and distributors of that equipment, and represents a leading indicator of manufacturing activity as investors prepare their operations for customers' future work orders. The regional results for June show considerable month-to-month rises in order volumes, but only the Southeast (+15.2%) and West (+19.3%) regions recorded year-over-year increases.

“Between conversations with members and other data points, we are expecting this momentum to carry into July even if total orders are slightly below June," Woods said.