Machine Tool Orders Decelerating Quickly

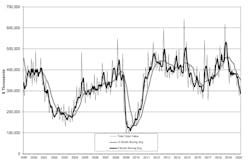

U.S. machine shops and other manufacturers increased their capital equipment purchases by 8.2% from February to March, up to $301.2 million, though that figure remains -29.3% below the March 2019 nationwide total for manufacturing technology orders, and raises the three-month total for 2020 to $863 million, -26.1% below the January-March 2019 total.

“We were anticipating an increase in orders from February since many companies’ fiscal years end in March, which typically drives up orders,” commented Assn. for Manufacturing Technology (AMT) president Douglas K. Woods. “Yet while orders in the first half of March were fairly robust, order volume decelerated rapidly in the second half of the month as stay-at-home orders were put into place."

The AMT's U.S. Manufacturing Technology Orders report is a monthly series that tracks new orders for machine tools and related products, nationwide and in six geographic sectors. It includes data for orders of metal-cutting and metal-forming and -fabricating equipment, based on information supplied by participating producers and distributors of that equipment.

Manufacturers' investments are indicative of planned and/or anticipated production programs, and thus are indicative of manufacturing industry demand.

Every region reported double-digit decreases in year-over-year and YTD totals for new orders.

The USMTO index has been trailing year-earlier and YTD results for most of the past twelve months, indicating slower industrial and consumer demand. Now, the prospect of an economic recession initiated by the COVID-19 pandemic has forestalled earlier hopes for a recovery in manufacturing activity.

“Going forward, we expect April and May orders to be significantly impacted by the inability of salespeople to meet with new prospects and visit customers’ facilities," Woods continued. "While videoconferencing is productive in some situations, it cannot effectively substitute for face-to-face meetings with customers at their facilities.

“This drop-off in quotations is most visible in the contracting machining sector, which represents nearly a third of the manufacturing technology customer base and is seeing a 70-80% drop in new quotation activity," Woods said. "If this rate of decline is representative of other key sectors, then much of the industry can expect a large drop-off in order volumes in the second and third quarters. Bucking the downward trend are defense, space, and medical equipment – and there are encouraging signs that automotive is slowing scaling back up as well.”