Cutting Tool Demand Weakened in November

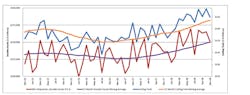

Domestic manufacturers purchased $209.42 million worth of cutting tools during November 2018, 6.3% less than during October ($223.46 million) but still 13.2% more than during November 2017 ($184.97 million.) These results match other recent indicators of slowing manufacturing activity. Through 11 months, total U.S. cutting tool consumption rose to $2.28 billion, a 12.9% increase over the January-November 2017 total.

“The numbers for November are very encouraging. We are seeing the same trends from month/month that we saw in 2017. The year/year and YTD/YTD are still strong. All signs point to continued growth in 2019, but with a cautious eye on how oil prices, tariffs, and interest rates impact consumer confidence," according to Steve Stokey, EVP and owner of Allied Machine and Engineering, and chairman of AMT Board of Directors.

Cutting tool consumption is regarded as a leading indicator of trends in manufacturing activity by the U.S. Cutting Tool Institute (USCTI) and AMT - the Association for Manufacturing Technology, the sponsors of the monthly Cutting Tool Market Report. The CTMR is compiled from actual cutting-tool consumption data reported by participating companies that represent the majority of the U.S. market for cutting tools.

Cutting-tool purchase, as summarized in the report, contrast with machine-tool orders, which indicate future activity as expressed by machine shops and other manufacturers prepare for planned or anticipated production programs. Such activity is expressed in AMT’s monthly U.S. Manufacturing Technology Orders report.

However, like the CTMR, the November USMTO report showed slowing demand in October and November, even though like the CTMR the year-over-year and year-to-date comparisons remain very positive.

“November 2018 cutting-tool industry data continues to support strong sales. Increasing raw material prices and skilled labor shortages have taken their toll in the short run but have not hurt the increased performance of 2018 when compared to 2017,” commented Brad Lawton, chairman of AMT’s Cutting Tool Product Group. "The market continues to watch trade negotiations that have dragged into 2019, and the potential impact they could have on manufacturing.”