Cutting-Tool Demand Shows Manufacturing Slowdown

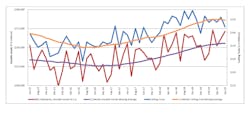

U.S. machine shops and other manufacturers purchased $198.9 million worth of cutting tools during June, -6.8% below the total for May ($213.4 million) and -6.3% less than the total for June 2018 ($212.4 million.)

Through the first six months of 2019, U.S. cutting tool consumption totals $1.25 billion, meaning year-to-date consumption is 3.2% higher than during the comparable January-June 2018 period.

The figures are drawn from the latest Cutting Tool Market Report issued by the U.S. Cutting Tool Institute (USCTI) and AMT – the Assn. for Manufacturing Technology. CTMR data is provided by participating manufacturers and distributors whose activities represent a significant share of the entire U.S. market for cutting tools.

According to USCTI president Phil Kurtz, “some of the softening is due to seasonality, the balance of the decrease reflects the European economies that have been slowing for a few months, while the U.S. economy shows signs of slowing slightly.”

Kurtz added that those factors, plus "the overhanging cloud of potential trade wars" may continue through the end of 2019.

“After a great start into 2019, it looks like cutting tools are on a downward trend following the lead of metal cutting machine tool orders,” commented Chris Kaiser, president and CEO of BIG Kaiser Precision Tooling. “It’s not necessarily a surprising development, since several industry segments and markets, like oi-and-gas, aerospace, and the automotive sector are struggling at the moment. This all seems congruent with developments in certain European countries too, like Germany."

New orders for machine tools have been slowing considerably in the past nine months, though that index is taken as leading indicator of manufacturers’ activity — with capital spending reflecting future production schedules.

Cutting tools are primary consumable product for machine shops and other manufacturers, making the CTMR a reliable index to the current pace of manufacturing activity overall.

According to “With over a 6% drop in volume from both May’s report and June 2018 report, we are starting to see the market soften. While some of the softening is due to seasonality, the balance of the decrease reflects the European economies that have been slowing for a few months, while the U.S. economy shows signs of slowing slightly. These two factors combined with the overhanging cloud of potential trade wars may keep pressuring the market through the end of 2019. It is important to note that YTD 2019 remains 3.2% higher than YTD 2018 which supports the overall market strength in the 1st half of 2019,” said Phil Kurtz, President of USCTI.