Cutting Tool Consumption Slowed in September

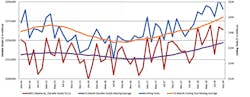

Domestic manufacturers consumed $210.58 million worth of cutting tools during September, 5.5% less than during August but still 20.4% higher than the September 2017 total. It was the fourth monthly decline in the past six months for the cutting-tool consumption index — an indicator of overall manufacturing activity — and yet the current result is 20.4% higher than the $174.92 million reported for September 2017.

The 2018 year-to-date total for U.S. cutting-tool consumption is $1.846 billion, 12.8% higher than the January-September 2017 total.

Johan Israelsson, senior vice president and head of global sales for Sandvik Applied Manufacturing Technologies, “2018 has been a very strong year for the cutting-tools industry in most market segments. In some areas demand has been extremely strong, such as in aerospace, defense, energy and general engineering.”

However: “September does seem to show some deceleration, which we are also seeing in some of the European markets,” Israelsson continued. “With this, and although year-over-year numbers are still strong, we may see a slowing growth over the coming periods.”

The consumption data is provided by the monthly Cutting Tool Market Report, CTMR presented by AMT – the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute. The CTMR documents actual sales totals for cutting tools by participating manufacturers. Cutting-tool consumption is offered as an indicator of manufacturing activity because cutting tools are a primary consumable product in the production of manufactured parts.

The cutting-tool index contrasts with the monthly U.S. Manufacturing Technology Orders Report, also issued by AMT, which reflects trends in future manufacturing activity as revealed by the purchasing decisions of machine shops and similar operations. The most recent USMTO revealed capital investments by those manufacturers rose 17.9% from August to September, totaling $608.92 million during September, and exceeded $1 billion for the two-month period, a near record.

“The September 2018 cutting-tool-industry data is still supporting strong sales. As the industry is enjoying this increased business volume, the majority of cutting-tool manufacturers are coping with the challenges of limited manufacturing capacity, increasing material prices, shortages of available labor, and global trade unrest because of imposed tariffs,” stated Brad Lawton, Chairman of AMT’s Cutting Tool Product Group.