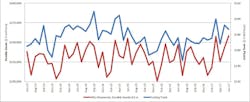

U.S. manufacturers, including machine shops, consumed $186.57 million worth of cutting tools during June, a decline of 2.8% from the May consumption level and yet 6.0% higher than the June 2016 level. Cutting tool consumption is offered as a reliable index to overall manufacturing activity, as cutting tools are a primary consumable in the manufacturing process.

“Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels,” according to the U.S. Cutting Tool Institute (USCTI) and AMT – the Association for Manufacturing Technology, who issue the monthly Cutting Tool Market Report, from which the latest figures is drawn. Data in the CTMR is based on totals reported by participating companies that represent the majority of the U.S. market for cutting tools.

While the June total represents just the second month of declining consumption in the first half of 2017, the six-month total consumption stands at $175.97 million, 5.8% higher than the January-June 2016 total.

“2017 continues to be a much stronger year for cutting tools than 2016,” according to Steve Stokey, president of USCTI. “High consumer confidence is a strong indicator that cutting tools sales will continue to improve through the second half of the year.”

There are some concerns over the direction of future consumption levels. The CTMR quoted Jarvis Cutting Tools president Costikyan Jarvis, who acknowledged that “macroeconomic” data (PMI, capacity utilization, employment data) supports a forecast for slow and steady economic growth.

However, Jarvis expressed some concern about the potential for global politics, Federal Reserve lending rate increases, and rising federal deficits, to negatively affect growth.

Jarvis also wished for more improvement in some specific “microeconomic” indices, citing “housing starts, agriculture and oil.”

He remained upbeat, however. “From the cutting tool producers viewpoint, our revenue growth is being driven by the strong market segments while Caterpillar’s recent improved outlook may signal growth in some of the remaining segments,” Jarvis stated.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.