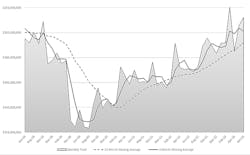

Midyear Cutting Tool Orders Raise Optimism

Machine shops and other manufacturers increased their spending on cutting tools by 3.2% from May to June 2023, up to $217.3 million for the month, according to the latest Cutting Tool Market Report issued by the U.S. Cutting Tool Institute and AMT - The Assn. for Manufacturing Technology. The result is an encouraging 23.5% rise over the $175.9 million reported for June 2022.

The positive trend is also evident in the year-to-date performance for cutting-tool consumption, totaling $1.24 billion for January through June, up 17.4% versus the comparable 2022 data.“U.S. cutting tool orders continue to rise after rebounding from a soft April,” observed USCTI president Jeff Major. “Second-quarter sales were strong versus 2022 sales for the same time period,” adding that “hiring pressures appear to have eased, which aids in the reduction in backlogs and drives business. There is optimism that the remainder of the year will remain positive.”

The CTMR is based on the proposition that cutting-tool consumption is an indicator of overall manufacturing activity because those purchases reflect activity across a range of manufacturing market segments served by machining operations. The data is based on purchases reported by participating companies who comprise the majority of the U.S. market for cutting tools.“The cutting-tool industry continues to record strong sales growth compared to 2022,” according to Everede Tool president Bret Tayne. “Much of this may be attributable to certain durable goods sectors, such as transportation and defense, that are core drivers of cutting tool consumption. If some of the critical customer categories are outperforming the overall economy, the cutting tool industry may enjoy better-than-anticipated growth.”