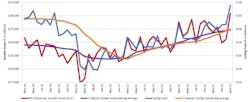

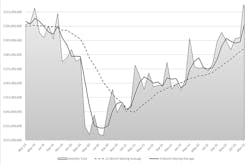

Have US Cutting Tool Orders Peaked?

Machine shops and other manufacturers consumed $225.6 million worth of cutting tools during March 2023, 14.6% higher than the February total ($196.9 million) and 14.9% more than the March 2022 total ($196.4 million), suggesting manufacturing activity is gaining some momentum. However, “While the March data was impressive and most shops remain busy, early indications are showing that Q2 will not continue to perform at this level,” according to Jack Burley, chairman of AMT’s Cutting Tool Product Group and Committee.

AMT and the U.S. Cutting Tool Institute jointly issue the monthly Cutting Tool Market Report. The CTMR presents cutting-tool consumption as an indicator of overall manufacturing activity because the purchases of which are reflect activity across a range of manufacturing market segments served by machining operations.CTMR data is based on totals reported by participating companies and represents the majority of the U.S. market for cutting tools.

Through the first quarter of 2023, cutting-tool consumption is 18.1% higher than the comparable total for January-March 2022.

“Cutting tool sales in March 2023 were astronomical, contributing to the best first quarter since 2019. Machinery orders have surged in the past two years, but sales of cutting tools had struggled to return to pre-COVID levels,” according to Chris Chidzik, principal economist at AMT – the Association for Manufacturing Technology. “The March 2023 numbers show that machines are starting to hit shop floors, demand for parts remains strong, and materials are available to make them.”But AMT’s Burley sought to temper any enthusiasm based on the March report. “The anticipated reduction in demand we thought would not happen until Q3 appears to be sooner than expected,” he said. “On a positive note, it was good for cutting tool producers to have a great first quarter to build upon.”