Cutting Tool Purchases Rise, but Suppliers are Cautious

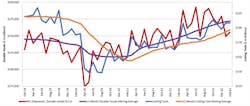

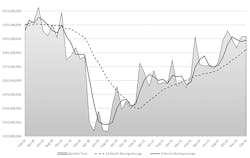

The figures are drawn from the most recent Cutting Tool Market Report, a collaborative release by the U.S. Cutting Tool Institute and AMT – the Assn. for Manufacturing Technology. Data in the monthly release are based on totals reported by participating companies and represent the majority of the U.S. market for cutting tools.

USCTI president Jeff Major was guarded about the apparently positive February results. “At this point, cutting tool sales for 2023 are up over the same time period last year,” commented Jeff Major, president of USCTI. “Business concerns still exist regarding inflation, the banking industry, and a potential recession near the end of the year.”

Because cutting tools are consumable products, the purchases of which are sensitive to demand across a range of manufacturing market segments served by machining operations, cutting-tool consumption offers an index to overall manufacturing activity.According to analyst Eli Lustgarten, cited by the CTMR sources with their February release: “Cutting tool manufacturers should remain cautious for the rest of the year. While business activity should hold, the economic data clearly points to a market peak.”

The analyst pointed to the March ISM index of manufacturing activity as an indicator of a contracting sector, with continued “softening” of new orders for manufactured products. “While we still expect cutting tool activity to finally surpass pre-COVID levels this year, producers need to remain aware of the ongoing reduction in machinery backlog and buildup of inventory,” Lustgarten stated.