Cutting Tool Demand Shows Manufacturing Uncertainty

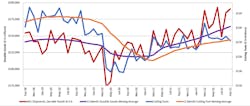

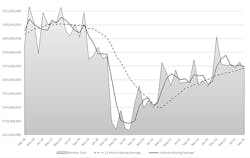

Having rebounded modestly in August, machine shops’ cutting-tool consumption dropped -3.3% in September to $172.1 million. The new figure is 5.5% higher than the September 2021 consumption total, leaving some doubt about the current strength of U.S. manufacturing activity.

Cutting-tool consumption is considered to be a reliable index to overall manufacturing activity because cutting tools are a primary consumable product in use across multiple industrial sectors.

Through nine-months of activity, U.S. machine shops and other manufacturers have purchased $1.6 billion worth of cutting tool products, 7.6% more than the January-September total for 2021.“As we review September’s data and the YTD performance of the cutting tool industry, two questions come to mind,” commented Brad Lawton, chairman of the AMT Cutting Tool Product Group. “How much of the YTD dollar volume increase is due to inflation, and is the September decline the start of the forecasted recession? As the industry struggles to answer these questions and other business demands, the next few months will provide answers.”

AMT and the U.S. Cutting Tool Institute publish the monthly Cutting Tool Market Report, which is the source of the consumption data. The data represents actual purchases of cutting tools by companies that comprise a majority of the domestic market for cutting tools.

“The decline in cutting tools sales from August to September continues a trend we have seen over the past six months as the Federal Reserve raises interest rates in response to the surge in inflation,” commented Bret Tayne, president of Everede Tool Co.

“Although September sales for the industry improved over September 2021, the trend for improvement year-over-year has been moderating as well,” Tayne continued. “On a more positive note, raw material costs appear to be more stable in recent months, which should translate into lower inflation and a slower curve in interest rate increases.”