Cutting-Tool Demand Rebounds

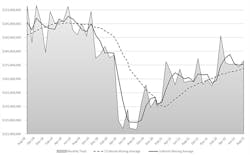

Machine shops and other U.S. manufacturers’ consumption of cutting tools rose to $178.1 million during August, up 2.6% from July and up 8.9% compared with the August 2021 consumption total. Through eight months of data for 2022, cutting-tool consumption stands at $1.4 billion, up 7.9% compared to the January-August 2021 period.

“Some of the pricing pressures our industry has been experiencing have begun to ease,” commented U.S. Cutting Tool Institute president Jeff Major, noting that “cutting-tool sales have remained steady since the beginning of Q2 2022. Year-over-year sales are up in the high single-digit percentages.”

Cutting tool consumption, as tracked in the monthly Cutting Tool Market Report, is considered to be a reliable index to overall manufacturing activity because cutting tools are a primary consumable product in use across multiple industrial sectors.The data is collected and supplied by the USCTI and AMT – the Assn. for Manufacturing Technology. The CTMR compiles data for actual purchases of cutting tools by companies representing a majority of the domestic market for cutting tools.

The increase in August consumption follows four months of slowing demand for cutting tools, and corresponds to an August rise in machine shops’ new-machine orders, reported by AMT in its U.S. Manufacturing Technology Orders report. USMTO data is a forward-looking index, however, describing machine shops’ plans for future activity.

“Some of the pricing pressures our industry has been experiencing have begun to ease,” commented Major continued, noting that “cutting-tool sales have remained steady since the beginning of Q2 2022. Year-over-year sales are up in the high single-digit percentages.

“There is some market uncertainty as we move into Q4 and beyond,” Major said, adding: “Indications are that the transportation sector will be a leading market in 2023.”

Tom Haag, president at Kyocera SGS Precision Tool, observed that cutting-tool manufacturers are doing well, in particular those supplying transportation manufacturers.“August was a surprisingly resilient month, considering that typically it is negatively impacted by the seasonality of automotive model changes and pent-up demand for summer vacations,” Haag said. The cutting-tool market is still not back to pre- pandemic levels, but it is continually clawing its way back. As automotive manufacturing continues to recover, aerospace production in the U.S.A. is still languishing behind. Forecasts of a complete recovery are still more than one year away as we face economic headwinds and supply chain bottlenecks.”