Cutting Tool Orders Flat Amid ‘Uncertainty’

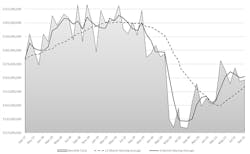

Machine shops and other U.S. manufacturers consumed $163.1 million worth of cutting tools during September, slightly less (-0.2%) than the August total but still 10.7% higher than the September 2020 total, as the manufacturing sector continues to perform well within an atmosphere of uncertainty.

Because cutting tools are required in the production of a wide variety of parts and components supplied to a range of industrial sectors, cutting-tool consumption is taken as an index of current manufacturing activity, comparable to shipments of durable goods. For the current year to-date, machine shops and other manufacturers have consumed $1.5 billion worth of cutting tools, up 7.4% compared to the January-September period of 2020.“The forecast for 2022 is a continuing increase in gross national product but not at the increasing rate as was seen in 2021,” explained Brad Lawton, chairman of AMT’s Cutting Tool Product Group. “The why is understood with one word: uncertainty! When we add up the following points – inflation, chip shortages, supply chain disruption, labor shortages, and the threat of increased business taxes – any cutting tool manufacturer understands the word. However, the resolve of the industry will continue to ride the wave of uncertainty and prepare for improved markets.”

AMT and the U.S. Cutting Tool Institute issue the monthly Cutting Tool Market Report, from which the figures are drawn. The CTMR presents real-time data on cutting-tool consumption supplied by a majority of the U.S. market for cutting tools.

A more encouraging note is offered by Greg Daco, chief U.S. economist at Oxford Economics USA and cited by AMT: “Following a summer lull in which rising COVID infections and growing supply-chain disruptions weighed on activity, the outlook for cutting tools appears to be brightening. In September, cutting tool shipments were 11% higher year-over-year than in 2020, in line with total durable goods shipments, up 9.2% year over year.“Still, year-to-date, cutting tool shipments remained 21% below their 2019 level,” he continued. “The U.S. economy lost some luster this summer, but demand appears resilient in the face of lingering supply-chain disruptions. With the health situation having improved considerably over the past few weeks, consumer spending is firming, and high-frequency data points to an acceleration in employment growth.

“The combination of rebounding global growth and increased government infrastructure investment should further contribute to the sectoral tailwinds in 2022,” according to Daco.