Cutting Tool Demand Shows Manufacturing Slowing

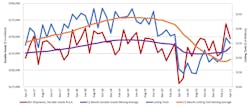

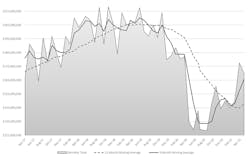

Machine shops and other U.S. manufacturers ordered $170 million worth of cutting tools during April, the second consecutive monthly decline in demand for consumables that are critical to a wide range of industrial activity.

The April result is -4.3% lower than the March total, which had fallen -2.6% below the February figure.

Even so, the latest total is +26.3% higher than the April 2020 figure. That total of course reflects a period of widespread manufacturing inactivity due to pandemic-related shutdowns.“While cutting tool industry sales contracted slightly from March to April, the general trend of recovery appears to be holding in spite of supply-chain disruptions, the lack of incentive for the workforce to return, and other challenges our manufacturing customers are navigating,” commented Bret Tayne, president of the U.S. Cutting Tool Institute. USCTI issues the monthly Cutting Tool Market Report jointly with AMT – the Assn. of Manufacturing Technology.

Because cutting tools are required in the production of multiple parts and components across a range of industrial sectors, cutting-tool consumption is taken as an index of current manufacturing activity. The data reflects actual results reported by companies participating in the CTMR program and represent a majority of the U.S. market for cutting tools.

“The April results show significant year-over-year increases, but that is benefiting from being compared to the first of the lockdown months,” observed Jarvis Cutting Tools president Costikyan Jarvis. “Unfortunately, the month-over-month results are not as strong. The April results suffered a 4.3% drop from March 2021 and indicate a pause in manufacturing’s return to pre-COVID levels.

“The macro trends are still strong,” he continued, citing April’s Purchasing Managers’ Index (60.7) and a University of Michigan consumer confidence figure (88.3) indicating a strong second-half 2021 and continued strength in 2022.

“Despite these positive trends, manufacturing is still facing immediate challenges,” Jarvis acknowledged, listing growth-inhibiting factors. “Commercial aerospace is still weak with no improvement on the near horizon. The chip shortage for automobiles is affecting demand, and finally, there are inflationary pressures being felt. The hiring of staff continues to be a challenge, and Section 232 tariffs are still in place.”