Cutting Tool Data Signals Manufacturing Recovery

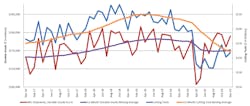

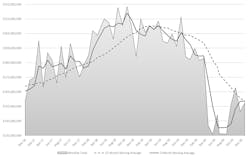

U.S. machine shops and other manufacturers consumed $157.3 million worth of cutting tools during December, +4% more than during November and -16.0% less than during December 2019, according to the latest Cutting Tool Market Report. This result reaffirmed the view that the manufacturing sector is staging a comeback from its mid-2020 declines, while still working to overcome the weak industrial demand that has beset manufacturers for more than a year.

According to U.S. Cutting Tool Institute president Bret Tayne, “The most recent data from cutting tool manufacturers support and extend the modest recovery we experienced in the last four months of 2020, despite weaker reports for the month of November. The recovery is uneven, to be sure. Some sectors of the cutting tool user base may not recover for an extended period of time, but the overall market data is improving.”

USCTI, in partnership with AMT, issues the monthly Cutting Tool Market Report to track cutting-tool consumption, as an indicator of overall manufacturing activity because cutting tools are used to produce components used by virtually every industrial sector. CTMR data includes report from participating companies that represent the majority of the U.S. market for cutting tools, and the wide application of cutting tools across multiple industries is comparable to durable-goods orders, according to the report's authors.

“Let’s face it, 2020 has had a dark cloud hanging over it where we are now looking for any semblance of good news, commented Tom Haag, president of Kyocera SGS Precision Tool. “While the year finishing with a decline of 22.2% appears devastating, the silver lining is that December’s monthly result compared to same month prior year was the best since March 2020.

Haag continued: “While we have all experienced a dramatic decline in business, it appears as though we have turned the proverbial corner and the coming first quarter tends to be strong in our industry. If automotive supply can keep continuity, this improvement should continue.”