Cutting Tool Orders Show Flat Manufacturing Demand

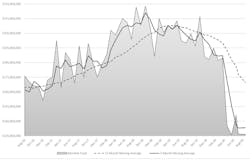

U.S. machine shops and other manufacturers consumed $137.8 million worth of cutting during July, -8.5% less than during June and -30.6% less than during July 2019. As cutting-tool consumption is reflective of overall manufacturing activity, the figures represent the seasonal dip that is common in many industrial sectors during the summer months, but also the decline in industrial demand resulting from coronavirus-related shutdowns.

The data is provided by AMT – the Assn. for Manufacturing Technologies and the U.S. Cutting Tool Institute in their monthly Cutting Tool Market Report.Through seven months of 2020, total cutting-tool consumption reported in the CTMR is $1.1 billion, meaning 2020 consumption is -21.2% less than during the January-June 2019 period.

The Cutting Tool Market Report presents cutting-tool consumption based on totals reported by participating companies, which represent the majority of the U.S. market for cutting tools.