Cutting Tool Demand Recovering from Shutdowns

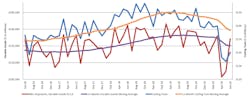

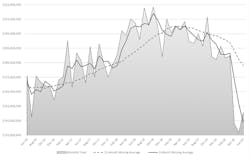

U.S. machine shops and other manufacturers consumed $150.6 million worth of cutting tools during June, a +10.1% increase over May's consumption, but still -24.6% less than the June 2019 consumption total. The figures are provided by the U.S. Cutting Tool Institute and AMT – the Assn. for Manufacturing Technologies in their monthly Cutting Tool Market Report.

Through six months of 2020, total cutting-tool consumption reported in the CTMR is $1 billion, meaning 2020 is down -19.7% compared with the January-June 2019 period.

The June CTMR result indicates a modest recovery for manufacturing, following widespread shutdowns imposed to contain the spread of the Coronavirus, but still indicating the broader decline in industrial demand that has been evident since late 2019.

“Consistent with recent reports on other industrial activity, the cutting tool industry rebounded somewhat in June," Bret Tayne, president of USCTI. "We still have a long way to go to return to activity levels that preceded the pandemic shutdown, but we appear to be headed in the right direction.”

The pace of any manufacturing recovery is difficult to measure, but the AMT's recent U.S. Manufacturing Technology Orders report for June — an index of future manufacturing activity, in contrast to the CTMR — showed demand for new capital equipment rose +55.7% from May (though still down -6.5% year-over-year) on the strength of demand from automotive, agricultural equipment, HVAC, and commercial refrigeration sectors.

"In this recession, both automotive and commercial aerospace industries, the two largest users of cutting tools, stopped producing for many weeks. In previous recessions, production has never gone down to zero; the implications of this are not yet understood," observed Costikyan Jarvis, president of Jarvis Cutting Tools. "These industries have supply chains that are international and complex, and it is unclear if their supply chains have fully recovered.

"In addition to a drop in demand, customers are also talking about seeing significant de-inventorying in the supply chain," Jarvis continued. "It will take several more months for everyone to understand both the shape of the recovery and how these industries adjust to the post-COVID world."