US Cutting Tool Orders Down -8.6%

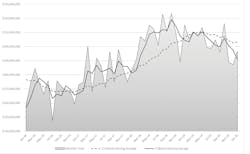

U.S. manufacturers consumed $196.5 million worth of cutting tools during January, a 5% rise over the consumption volume for December 2019, but a -8.6% decrease from the January 2019 figure. Cutting-tool consumption, i.e., orders, are an indicator of overall U.S. manufacturing activity: cutting tools are directly involved in production processes, and the purchases parallel actual production levels for manufacturers. As a category, cutting-tool orders mirror overall manufacturing durable goods orders.

The data is supplied by AMT – the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI) in the Cutting Tool Market Report they issue jointly each month.

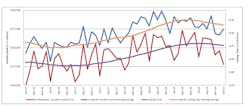

The CTMR differs from AMT's monthly U.S. Manufacturing Technology Orders report, which forecasts future manufacturing activity based on capital investment by machine shops and other manufacturers; the January figures in that series recently showed a similar slow start for 2020, may be prolonged by the effects of the coronavirus on industrial activity, supply chains, and purchasing decisions.

The CTMR data presents cutting-tool consumption based on the totals reported by the participating companies and represent the majority of the U.S. market for cutting tools.

Haag spoke more specifically of the factors underlying the present difficulties. "The metalworking industry is feeling the negative effects of a flat automotive market and an aerospace market that has virtually halted the entire supply chain of the 737MAX," he said.

"IHS forecasts have warned of a drop in consumption in the first quarter and this has unfortunately come to fruition,” Haag added.