Cutting Tool Demand Shows Manufacturing Remains Weak

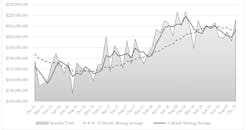

Weak U.S. manufacturing demand continued to be reflected in machine shops' and other manufacturers cutting-tool consumption during October. The $216.1 million total for U.S. cutting-tool consumption during October 2019 actually rose 10.2% over the revised September total, but fell -3.3% below the October 2018 result. The January-March 2019 cumulative total for U.S. cutting-tool consumption is now $2.1 billion, meaning that 2019 year-to-date is nearly even (-0.1%) with the 2018 figure.

The data is supplied by AMT – the Assn. for Manufacturing Technology and U.S. Cutting Tool Institute, which together compile the Cutting Tool Market Report. CTMR presents cutting tool consumption as a leading indicator of both U.S. manufacturing activity, as it is a true measure of actual production levels.

The CTMR sponsors cited IHS to note that the September-to-October improvement is a largely seasonal effect, and that the October result represented the sixth consecutive month with a year-over-year decline in cutting-tool consumption, "bringing 2019 below 2018 on a cumulative year-to-date basis," according to Scott Hazelton, managing director of Economics & Country Risk at IHS Markit.

"Automotive and aerospace are the two largest demanders of cutting tool products," Hazelton added. "It is encouraging that October’s decline was the smallest of the past three months, and may indicate that a trough is nearing.

"Trade frictions appear to be easing," he continued, "and Boeing is expected to increase production in the first quarter of 2020. It is premature to expect a resumption of growth, but 2020 looks to offer some improvement.”