Unavoidable Decline for Chinese Machine Tool Output

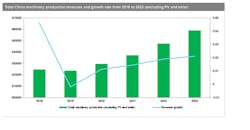

Chinese machine-tool sales are due to decline for 2019, according to a third-quarter report issued by IHS Markit | Technology, which cites "weak demand from downstream industries" as the primary cause of an unavoidable year-over-year drop in revenues. In its Machinery Production Market Tracker - Q3 2019 report, now available, IHS forecast the annual revenue decline to be 0.2% compared to 2018.

However, weak demand is only part of the dilemma for companies supplying machine tools in China. “The uncertainty in international relations, including the Sino/U.S. trade dispute, has impacted investment sentiment, resulting in a decline in machinery demand this year,” IHS Markit analyst Lisa Wang.

China's machine-tool sector is described as the basis of that country's manufacturing market, and that it is being significantly affected by the weak demand from automotive, electrical and electronics, and marine industries, which represent nearly half of machine-tool demand.

Chinese automaking may account for nearly 30% percent of machine-tool market demand, but Chinese auto sales have been in recession since July 2018. Despite a sales rebound in September 2019, the overall decline remains quite severe over the past 15 months, with automotive sales and production dropping, including for hybrid and electric vehicles.

The drop in industrial demand has resisted China's attempts to counter the trend. “The Chinese government’s current stimulus package is dominated by tax cuts, business-fee reductions, and other measures that steer bank lending to small- and medium-sized private firms," Wang explained. "These measures have failed to lift business investment and consumer demand. The resulting decline of global and domestic demand has undercut the growth of machinery production in 2019.”

Chinese machine-tools production will decline by 20.6% percent in 2019, according to the IHS Markit | Technology forecast.