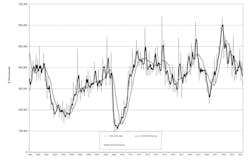

Contract machine shops cut their new orders for capital equipment during April, contributing significantly to the overall -25.6% drop in manufacturing technology orders from March, or a total of $317.9 million for the entire sector. That figure represents -5.4% decrease in new orders from April 2023, and it brings the four-month total for new orders to $1.428 billion, or -16.2% less than the January-April total for 2023.

However, in the latest release of its U.S. Manufacturing Technology Orders report, AMT - the Assn. for Manufacturing Technology noted that the year-to-date order total is almost 5% higher than the average order volume for the January-April period since the series began in 1998.

The USMTO is a monthly review of new orders for machine tools (i.e., “manufacturing technology”), and it serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs. AMT’s monthly update compiles data for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

“Machinery orders have been steadily declining since hitting a peak in the fourth quarter of 2021,” AMT noted, although “orders through April are nearly 5% above the average order volume through the first four months of a year since USMTO began tracking orders in 1998.”

The drop in new orders from contract machine shops is important because those operations represent the largest customer segment for manufacturing technology, though their decrease in orders was less than the double-digit decline in orders by overall market. Another crucial market segment, automotive manufacturing, also is reducing its investment in manufacturing technology.

In contrast, aerospace manufacturing continues to invest in new capital equipment, which has been notably evident in new orders in the Southeast region.

Even so, the Southeast region’s April total for metal-cutting machinery was $44.66 million, a -35.8% drop from March. The year-over-year result was better, up 15.4% versus April 2023; and the regional YTD increase in metal-cutting machinery orders is 18.6%.

Only one of the six regions – the West – reported increased demand for metal-cutting machinery during April, with $68.09 million in new orders. That result is 5.1% higher than the March result, and 30.9% higher than the same figure for April 2023. For January-April, the region’s metal-cutting machinery totaled $245.82 million, which is a 9.9% rise over last year’s first four months.

Each of the other four regions posted double-digit percentage decreases in new metal-cutting machinery orders versus the March totals, and again versus the April 2023 totals. Their YTD results are similarly unimpressive.

But in it’s announcement AMT noted that “the decline in orders appears to be stabilizing.” It cited Oxford Economics revised 2024 forecast, which now offers that 2024 will finish “flat or slightly down compared to 2023,” though it also predicts a rise in new orders through the remainder of the current year. That view is connected to the assessment that industrial production has found its low point for the current business cycle in most of the industrialized economies of the world.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.