Machine Tool Orders Rising, but Trailing 2023

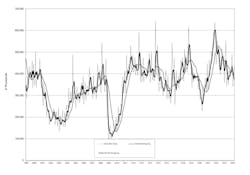

New orders for CNC machine tools rose 24.9% from February to March, up to $435.69 million in the latest total reported by AMT - the Assn. for Manufacturing Technology in its monthly U.S. Manufacturing Technology Orders report. Even so, the new result falls -21.3% below the March 2023 figure, and the 2024 year-to-date total for manufacturing technology orders at $1.13 billion falls -18.6% below last year’s January-March new-order total.

The USMTO report is a monthly review of new orders for machine tools (i.e., “manufacturing technology”), and it serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs. AMT’s monthly update compiles data for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

In its comment on the March results AMT observed that the Federal Reserve Bank’s lack of action to reduce interest rates – recognizing persistent high inflation – and a strong labor market have been limiting business expansion activity, and thus weighing against new order activity by machine shops and other manufacturers.

“Despite this general unease, there remain several pockets of opportunity driven by government spending and technological advancement,” according to AMT.

Typically, the highest volume of MT orders is received from ‘contract machine shops,’ and according to the March result that segment’s orders rose in March to the highest level in the past year, and yet remain -11.3% less than in March 2023. “Customers ordering parts from contract machine shops have increasingly turned away from longer-term procurement cycles in favor of placing month-by-month orders or making sporadic, one-off purchases,” AMT reported. “As a result, machine shops have been hesitant to make additional machinery investments.”

A better indicator comes from manufacturers of electrical generation and power-transmission equipment, whose new MT orders rose to their highest result since March 2023. That continues a trending upward since last September, which AMT attributed to government investments in alternative energy technologies.

AMT also predicted that sector may become a reliable source of growth in manufacturing technology orders on the strength of alternative-energy sector demand.

Regionally, new orders for manufacturing technology rose 87.6% from February to March in the Northeast; 39.1% in the North Central-West; and 37.2% in the Southeast region. The West (8.5%) and North Central-East (2.5%) reported single-digit rises for March, and only the South Central region experienced a month-to-month decline (-3.8%) in new orders.

Year-over-year new-order new-order totals were in decline across all six regions, and the YTD results were similarly poor.

AMT noted, however, that the Southeast (16.9%) and West (2.6%) regions showed growth in manufacturing technology orders for Q1 2024 versus 2023 and 2024. In the case of the Southeast, it attributed the rise to increased orders from aerospace operations preparing for increased demand from defense programs, as well as some manufacturers having relocated to the region.

Growth in MT orders in the West region is based on demand from computer and electrical equipment manufacturers working on government and private investment in semiconductor manufacturing programs.