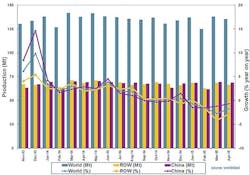

Raw steel production declined worldwide during April totaled 137.78 million metric tons, falling 1.88% overall from the March result, and 1.75% from April 2014. The results represent raw steel production in 65 countries represented by the World Steel Association, which reports tonnage and capacity utilization on a monthly basis.

In addition to falling production volumes, World Steel reported raw steel capacity utilization rose 0.9% from March, but fell 3.2% worldwide from the April 2014 report.

Raw steel (also known as crude steel) is the product of basic oxygen furnaces and electric arc furnaces, prior to metallurgical refining and casting into semi-finished products, such as slabs, blooms, or billets. World Steel’s results include data for carbon and carbon alloy steel output. Stainless steels and other specialty alloy steels are not included.

The association also issues semi-annual forecasts for steel consumption, and in its two most recent reports it has identified trends for declining rates of demand. Last month, World Steel issued a short-range outlook for steel consumption anticipating an increase of just 0.5% this year over 2014. That would mean total global steel consumption of 1.54 billion metric tons during the current year. For 2016, the Association forecasts global steel consumption rising another 1.4%, totaling 1.565 billion metric tons.

The continued decline in raw steel production during April included a 0.83% decline in output by Chinese steelmakers from March to April, in line with a 0.7% decline from their April 2014 output.

China remains by far the world’s largest steelmaking nation, typically producing about half of all steel on an annual basis. However, Chinese government industrial policy has mandated a consolidation of steel capacity there, and idling of older and less productive operations.

For the year to date, Chinese steelmakers have produced 69.4 million metric tons of raw steel, 1.3% less than the sector produced during the comparable January-April 2014 period.

Elsewhere in the Asian region, Japanese steelmakers produced Japan produced 8.4 million metric tons of raw steel last month, 9.5% less than during March, and 6.1% less than during April 2014. The world’s second-largest steelmaking nation has produced 8.95 million metric tons of steel this year, 3.7% less than during the first four months of 2014.

South Korean steel producers’ April output was 5.8 million metric tons, down 2.4% compared to March, and down 6.6% compared to April 2014. For the January-April period, South Korea is 5.5% behind the pace of 2014.

German steelmakers led all European Union steelmakers, as per usual, with 3.6 million metric tons of raw steel produced during April, 5.9% less than during March and 1.9% less than during April 2014. That country has produced 14.7 million metric tons through the first four months of this year, 1.97% less than during the comparable period of 2014.

Steel production declined 5.7% across the 28 nations of the EU, with large-volume producers like Italy reducing its output by 11.46%, France by 8.48%, and Great Britain by 17.48%. By contrast, raw steel production in Spain was 6.1% higher in April than in March.

For the year-to-date, steel production in the EU total 58.1 million tons, or 0.33% less than during January-April 2014.

Beyond the EU, Russian steelmakers produced 6.1 million metric tons of raw steel during April, 1.27% less than during March and 3.2% more than during April 2014. Ukraine produced 1.9 million metric tons of crude steel, down by -24.9% compared to the same month 2014.

In April 2015, Russia produced 6.1 million metric tons of crude steel, up by 3.2% over April 2014. Through the first four months of this year, Russian steelmakers have produced 24.3 million metric tons, or 5.22% more than during 2014. In Ukraine, steelmakers’ April output rose 13.7% from March to 1.9 million metric tons, which was 24.9% less than during April 2014. For 2014 to-date, Ukrainian steelmakers have produced 7.1 million metric tons, 29.9% less than during the same four months of 2014.

Raw steel production in Brazil rose 5.2% from March to 2.9 million metric tons during April, up by 4.4% over April 2014. For the current year, Brazilian raw steel output stands at 11.3 million metric tons, 1.6% more than over the comparable four-month period of 2014.

Finally, in the U.S., raw steel production rose by just 0.39% from March to April, totaling 6.5 million metric tons. That figure is 9.8% less than during April 2014. For the January-April period, U.S. raw steel production stands at 26.4 million metric tons (29.03 million short tons), which is 8.5% less than during the comparable four months of 2014.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.