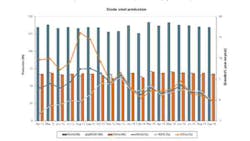

Global steel output slipped less than 1% from August to September, down -0.55% to 134.4 million metric tons, marking the fourth consecutive month for declining output across the 65 nations reporting to the World Steel Association. This total also marks a 0.1% drop from the September 2013 result, and brings the year-to-date total for raw steel production worldwide to 1.23 billion — which is 2.1% more than was produced during the comparable nine-month period of 2013.

At the same time, steelmakers increased capacity utilization 1.9% over the August rate — possibly reflecting capacity restored to use after summer shutdowns, as in several European nations. Even so, the current global steel capacity utilization is 2.6% lower than the September 2013 rate.

The steady third-quarter slowing of steelmaking activity seems a response to World Steel Assn.’s recent short-term forecast for declining global steel consumption. The group’s economics team sees 2014 global steel consumption rising only 2.0% over the 2013 “apparent steel usage”, which increased 3.8%.

“The positive momentum in global steel demand seen in the second half of 2013 abated in 2014 with weaker than expected performance in the emerging and developing economies,” observed Hans Jürgen Kerkhoff, chairman of World Steel Economics Committee. “As a consequence we are issuing a lower steel demand growth figure than our forecast released in April this year.”

In its previous Short Range Outlook, issued in April, World Steel forecast 2014 global steel consumption would rise 3.15% for 2014.

Looking out to 2015, World Steel economists see consumption remaining steady with a 2.0% increase. The previous Outlook report forecast a 3.3% increase in consumption for 2015.

China remains the world’s largest steelmaking nation, but that country’s central planners have been implementing consolidation programs to curtail capacity expansion – efforts which appear to be affecting output levels. During September, Chinese steelmakers produced 67.5 million metric tons of raw steel, nearly 2.0% less than during August yet even with the September 2013 total. For the year to date, China’s raw steel output stands at 618 million metric tons, which is 2.3% more than was produced during the January-September 2013 period.

South Korea Rising, Germany Slowing

In Japan, the second-largest steelmaking nation, raw steel production decreased 1.1% from August, to 9.2 million metric tons. That represents a decrease of -0.5% versus the September 2013 output, and at 83,123 million metric tons Japanese steelmakers have produced 0.8% more raw steel during 2014 than during the same nine-month period of 2013.

India’s steelmakers produced 6.8 million metric tons of crude steel, 2.6% less than in August and 2.5% more than during September 2013. Year-to-date steel production in India is 62,412 million metric tons, or 1.8% more than during January-September 2013.

South Korean steel production rose 1.77% during September, to 5.7 million metric tons, which is 10.1% more than during September 2013. The current year’s total is 53.27 million metric tons, or 9.4% more than the nine-month total for 2013.

Steelmaking in the European Union rose 16.28% from August to September, a figure indicating the effects of summer shutdowns in many EU countries: the same result is down 1.7% from the September 2013 figure.

The region’s largest steel producing nation is Germany, where 3.5 million metric tons were produced during September, up 13.12% from the previous month but down 3.0% from September 2013. The current year’s total is 32.5 million metric tons, 2.5% more than the comparable figure for 2013.

Italy, the second-largest producing nation in Europe, produced 2.2 million metric tons of raw steel during September, more than doubling (118.8%) the August result though just 0.7% more than the year-ago figure. Italy’s year-to-date production total is 18.4 million metric tons, 2.4% more than last year’s comparable total.

The war between Russia and Ukraine has impacted production for two of the largest steelmaking countries in the world. Russian steelmakers produced 5.9 million metric tons of steel in September, 4.36% less than during August but 6.0% more than September 2013. The nation’s year-to-date tonnage is up 3.1% versus last year’s total, now at 53.4 million metric tons.

Steel output in Ukraine also declined from August to September. The latest figure, 1.7 million tons, is down 3.79% from last month, and down 37.0% from last September. The year-to-date result for Ukraine is just 24.9 million metric tons, down 14.2% from 2013.

In Brazil, September raw steel production fell 2.89% from August to 2.9 million metric tons, and that figure is also down by 3.8% versus September 2013. For January-September, Brazilian steelmakers have produced 25.5 million metric tons, or 1.3% less than during the comparable period of 2013.

Finally, in the U.S. raw steel production during September totaled 7.28 million metric tons (8.02 million short tons), or 6.1% less than during August. That figure brings U.S. year-to-date raw steel production to 66.3 million metric tons (73.1 million short tons), which is 1.6% higher than the January-September 2013 total.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.