Chinese industrial machinery production is in line for medium-term expansion, but at a slower rate than in the recent past, setting up a dilemma for economic planners, according to a new report by IHS Technology. Their challenge is to target some sectors already strained by oversupply that resulted from earlier incentive programs. This is one detail of a larger economic picture that has central planners preparing to launch a new series of economic stimulus programs, smaller than the efforts initiated in 2009 but aimed at slowing or reversing the apparent decline underway in China’s industrial economy.

IHS Technology’s Chinese Machinery Production study indicates that this year’s 7.8% growth rate, to an estimated $475 billion, is only a slight decline from the 7.9% growth rate of 2013. The details of the 2013 results are significant, because the growth of domestic economic sectors is the factor that determines the growth of different industrial machine markets.

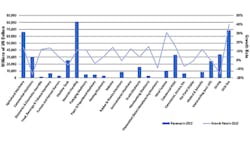

Industries that grew during 2013 were agricultural machinery; elevators and escalators; electronics and electronics assembly; oil and gas; medical and scientific devices; food, beverage and tobacco machinery; and packaging machinery.

But because of weak investments overall in 2013, most heavy industries, including mining machinery and cranes and hoists, declined last year. (One exception to the general decline in heavy industries was the wind turbine sector.)

2014 Highs and Lows

This year, growth in Chinese industrial machinery is led by oil-and-gas equipment, robotics, packaging machinery, wind turbines, and agricultural machinery. Declining sectors will b mining machinery, construction machinery, and metalworking machinery, all of which continue to struggle with overcapacity.

During the first three months of 2014 China’s real GDP expanded by 7.4% over Q1 2013, but that was less than the 7.7% growth rate Q4 2013. According to IHS Technology, this means that China’s economy continued to weaken into first quarter of this year 2014, struggling with weakening domestic and foreign demand.

As a result, Chinese machinery production growth is declining: the Q1 2014 showed a year-on-year increase of 3.6%, but that is down from 9.9% in Q4 2013.

“Since 2012 many industries in China—including construction machinery, machine tools and metalworking—had suffered overcapacity,” explained IHS Technology’s Jay Tang, an industrial automation analyst. “While this continues to impact market growth, the Chinese government is also engaging in a series of efforts that amount to a ‘mini-stimulus.’ These efforts are beginning to show signs of working, but it will take some time for stronger results to come.”

IHS Technology noted a statement by the State Council of China that its stimulus programs will be comprised of one-year extensions (through 2016) of three policies:

a) an existing exemption from business taxes for the first ¥ 60,000 (approximately $9,740) of the profits of small businesses;

b) plans to open 6,600 km (4,100 miles) of new rail lines this year, up 1,000 km from last year; and,

c) plans to build or renovate homes for 4.7 million people living in makeshift shelters.

Even so, IHS Technology contends that China’s economic growth will be restrained during the medium term due to significant declines in demand and the withdrawal of larger structural reforms. But, as the Chinese government seeks to balance its structural reform and maintain growth, it will face a new problem with unemployment. IHS Technology said demographic trends indicate China will have more than 10 million laborers out of work each year during the next five years. This means the government and its economic planners are under pressure to create jobs, and IHS estimates that a real GDP growth of 7.0% will generate about 13 million new jobs, approximately equal to the projected excess labor.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.