US Cutting Tool Orders Climb Again

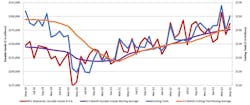

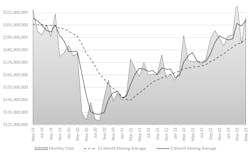

U.S. manufacturers purchased $210.6 million during May 2023, 10.8% more than during the previous month, indicating domestic manufacturing activity continues to be stable even as other indicators suggest a future economic recession. The new figures – which are supplied by the U.S. Cutting Tool Institute (USCTI) and AMT - the Assn. for Manufacturing Technology in their monthly Cutting Tool Market Report – also show a 20.0% improvement over the May 2022 result, and bring the year-to-date total for cutting-tool purchases to $1 billion, 16.1% higher than January-May 2022.

“The cutting tool industry remains inconsistent after 2023 started strong, but demand seemed to decline each month through April,” observed Kyocera SGS Precision Tool president Tom Haag. “Now, May is showing some resilience. The common buzzword for the cause of this variation is ‘supply chain.’ Looking to the summer, July and August generally trend down due to automotive-model changes and summer holidays.

“However,” Haag continued, “2022 trended upward, so we hope to see a repeat performance despite economic headwinds.”The CTMR data is based on totals reported by participating companies and represents the majority of the U.S. market for cutting tools.

Cutting-tool consumption is an indicator of overall manufacturing activity because those purchases reflect activity across a range of manufacturing market segments served by machining operations. “The cutting tool consumption in May indicates that metal-cutting production has not been drastically affected yet by a slowdown,” according to AMT’s Jack Burley, chairman of the Cutting Tool Product Group and Committee. “There is some hesitancy from the market for new projects, but overall we are still trending in the right direction.”