Strong Machine-Tool Demand Undercut by Market Uncertainty

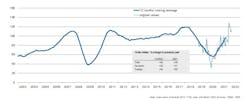

"Orders for our industry continued to flow in during the first quarter of this year," according to VDW executive director Dr. Wilfried Schäfer. "They were only 8% below the figures posted in the record year of 2018."

The rebound in demand for German machine tools is consistent with monthly results for the U.S. machine-tool industry published by AMT – the Assn. for Manufacturing Technology. The U.S. Manufacturing Technology Orders report for March 2022 is +20.4% higher than the March 2021 figure, and puts the current year-to-date order volume at $1.47 billion, +26.5% ahead of the January-March 2021 total.

However, Schäfer reported that the effects of the Russia-Ukraine war may depress new machine-tool orders in the coming months, as evidenced by the most recent growth rates, which have been significantly lower.

Another drag on future orders will be ongoing supply bottlenecks. "This issue will be with us for quite a few months," Schäfer projected.Supply-chain disruptions also explain why deliveries of machine tools lag the orders. In the first quarter, VDW reports machine-tool production rose by 6%, prompting the VDW to lower its 2022 production forecast from 14 to 8% growth.

"At present, the new machines are simply ending up in storage, as many of them cannot be put into operation because of missing parts," Schäfer explained. These machines do not appear in the production figures until they are shipped.

China is currently the source of much of the current supply-chain uncertainly, according to VDW. Continuing lockdowns in numerous major cities and industrial centers are preventing customers from taking delivery of machines, and service personnel from traveling to customer locations.

VDW also noted that German machine-tool exports are being depressed by supply-chain problems, too.

There was a slight (1%) increase in first-quarter exports, but particular markets have posted declines: Europe (-2%), the Americas (-1%.) Exports to U.S. buyers fell by -6% in the first quarter of 2022.

Exports to Asia grew 8% in Q1. At 4%, exports to China (the largest sales market for German machine-tool exports), grew only moderately at the beginning of the year.

"All in all, the economic uncertainties facing our industry remain considerable going forward," Schäfer said. "A prolonged war in Ukraine, further soaring prices for energy, logistics and raw materials, and a complete embargo on oil and gas supplies from Russia would have a significant impact.

“Nevertheless, the high levels of orders currently on the books are easing the situation,” he concluded. “There is therefore a chance that some of this year's downturn in growth will turn into sales figures in the coming year. International machine tool consumption is estimated to rise by 10% this year, which could also help matters."