2020 Global Steel Demand to Drop 6.4%

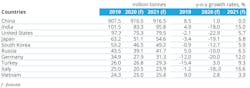

The World Steel Assn. issued a semi-annual Short Range Outlook, forecasting that 2020 global steel demand will shrink 6.4% year-over-year, declining to 1.654 billion metric tons, as a result of the COVID-19 pandemic. The forecast further projects that steel demand will recover to 1.717 billion metric tons in 2021, rising 3.8 % over 2020. World Steel is a trade association representing steelmaking companies worldwide. The Short Range Outlook is issued at six-month intervals by the World Steel Economics Committee. The association also issued a monthly summary of raw-steel output in the 64 countries producing steel on a commercial basis.

“The COVID-19 crisis, with its disastrous consequences for public health, also represents an enormous crisis for the world economy," according to Saaed Al Remeithi, chairman of the World Steel Economics Committee, which produced the Short Range Outlook. "Our customers have been hit by a general freeze in consumption, by shutdowns, and by disrupted supply chains. We therefore expect steel demand to decline significantly in most countries, especially during the second quarter."

Al Remeithi offered that a "slow recovery" may begin to be seen in May 2020 data. The forecasters assume that most countries’ lockdown measures will ease during June and July, and that the major steelmaking economies will not suffer from substantial secondary waves of the pandemic.

While all steel-consuming sectors are affected by "lockdown measures," the forecasters found mechanical machinery and automotive sectors are highly exposed to a prolonged demand shock, as well as to disruption in global supply chains. Changes in working procedures in the steel-using sectors to fulfill the requirements of social distancing have been carried out, and these changes will potentially lead to lower productivity and an extended production cycle.

China’s economic recovery started in late February, the forecasters state, and its economy is quickly approaching "normalization, except for the hospitality and tourism sectors." The pause in economic activity during February led to a -6.8% drop in GDP and -16.1% in fixed asset investment during Q1 2020. Industrial production fell by 8.4%, with the worst effects being a-44.6% Q1 decline in automotive production.

However, by the end of April, all of China's major steel-using sectors were back to near full productivity, though the manufacturing sector is significantly hindered by a collapse in export demand. China's construction sector has returned to 100% productivity since April 8, the forecast noted.

Recovery of Chinese steel demand will be more visible in the second half of 2020, driven by construction, especially infrastructure investment, prompted by new government infrastructure initiatives. "Recovery in manufacturing will be slower due to a severe recession in the global economy, but the automotive industry will get some support from incentive measures," the forecast noted.

Steel demand in the world's developed economies is forecast to decline by -17.1% in 2020, led by consumer and service sectors as spending drops. "A spillover from substantial job losses and bankruptcies, weak confidence, and continued social distancing measures suggest only a partial recovery of 7.8% in 2021," the forecasters noted.

EU steel demand contracted -5.6% in 2019 due to the sustained manufacturing recession. Europe's manufacturing sector, which was forecast to begin recovering early in 2020, fell into a deeper recession as lockdown measures plunged new orders for steel products

The EU automotive sector is expected to be the worst hit, though its construction sector could remain relatively resilient.

In the US, the COVID-19 pandemic is driving a manufacturing recession, which is expected to bottom-out in Q2 2020. The fall in oil prices puts more downward pressure on already falling energy-sector investment. U.S. unemployment is reducing income and confidence, which is depressing residential construction, and while non-residential construction is performing relatively better the overall construction sector will recovery only slightly in 2021.

Japanese steel demand has been weakening since Q2 2019 and will continue to contract by double digits in 2020, with falling exports and stalling investments reduce steel consumption in the automotive and machinery sectors. Japanese construction will see a relatively small contraction, as public works projects proceed.

In South Korea, major steel-consuming sectors are expected to see a double-digit decline, resulting from falling export markets and a weak domestic economy.