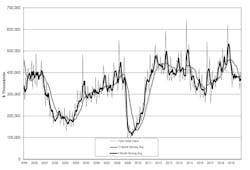

US Machine Tool Orders Down 17% in 2019

U.S. manufacturers' orders for new machine tools fell -17.1% during 2019, totaling $4.54 billion for the 12-month period, $938.3 million less than the order value for January-December 2018. However, the December 2019 monthly total for new orders delivered a hopeful note in the AMT-the Assn. for Manufacturing Technology's monthly U.S. Manufacturing Technology Orders report: it recorded orders worth $403.77 — 24.4% higher than the November total and -9.0% less than the December 2018 result.

The USMTO report published each month by AMT-the Assn. for Manufacturing Technology offers a leading indicator of manufacturing industry demand, as machine shops and other manufacturers invest to complete planned or anticipated production programs. AMT reports nationwide and regional data for orders of metal cutting and metal forming and fabricating equipment, based on data supplied by participating producers and distributors of that equipment.

“Despite the overall drop in orders in 2019, it was still one of the strongest years in the past five years,” stated Douglas K. Woods, president of AMT. “And, in December our members received orders that manufacturers had put off for most of 2019 due to a lack of confidence and fear of a recession expected in manufacturing in late 2019 or early 2020.”

“Despite the overall drop in orders in 2019, it was still one of the strongest years in the past five years,” Woods commented, “and in December our members received orders that manufacturers had put off for most of 2019 due to a lack of confidence and fear of a recession expected in manufacturing in late 2019 or early 2020."

New-order totals in each of the six regions tracked by AMT showed double-digit decreases in cumulative annual value. In the Northeast region, December new orders increased +33.5% from November, to $90.25 million, but that figure is -11.4% less than the December 2018 total. For the 12-month period, the region's order total was $890.4 million, down -11.9% from 2018.

The Southeast region reported December new orders worth $45.0 million, and a 12-month total of $584.9 million.

In the North Central-East region, December new orders totaled $90.8 million, +27.1% versus November, but -13.3% behind the December 2018 result. For the full year, that region's new orders totaled $1.04 billion, a year-over-year drop of -11.2%.

For the North Central-West region, new orders in December totaled $83.9 million, +55.7% higher than November and +14.2% higher than December 2018. The regional year-to-date order totaled $789.7 million, a decline of -28.7% over the 12-month 2018 result.

The South Central region's full-year new-order total was $377.8 million.

In the West region, December new orders fell -4.2% from November to December, to $60.7 million, which is also -25.4% less than the December 2018 total. For the full year, the region's new orders fell -9.8% to $836.22 million.

"December 2019 may have seen a bump in investment activity, but it is still too early to tell if that is the start of a trend," AMT's Woods continued. "We expect the beginning of 2020 to continue to be slow relative to 2019 levels, but the second half of the year should see an upswing in the market.”