Boeing Commercial Airplanes has increased its 20-year forecast for new-aircraft demand, predicting a 4.7% rise in orders through 2036. In “real numbers,” the OEM identifies demand for 41,030 new jets over the next two decades, which it projects would be worth $6.1 trillion dollars.

Every year Boeing issues a 20-year, Current Market Outlook as a guide to analysts and investors, and to give context to its development programs and strategic planning. It also offers detailed forecasts for demand various geographic regions.

The new forecast is decidedly more optimistic than the 2016 CMO offered. Then, Boeing forecast demand for aircraft would rise 3.6% or $5.93 billion, through 2035.

Earlier this month, rival jet-builder Airbus issued a slightly less optimistic, 20-year forecast anticipating 4.4% growth for new-aircraft demand.

"Passenger traffic has been very strong so far this year, and we expect to see it grow 4.7 percent each year over the next two decades," stated Randy Tinseth, vice president of Marketing, Boeing Commercial Airplanes. "The market is especially hungry for single-aisle airplanes, as more people start traveling by air."

Demand for single-aisle aircraft (e.g., Boeing’s 737 series) once again will see the greatest expansion over the forecast period, driven by demand from low-cost carriers and the need to serve emerging markets. Overall, Boeing sees global demand for 29,530 new single-aisle jets, almost 5% than it forecast in 2016.

The 20-year wide-body jet forecast calls for 9,130 new aircraft through 2036, notably to address a “large wave of potential replacement demand beginning early in the next decade,” according to Boeing. Its 787 and 777 series jets serve that segment of the market.

“With more airlines shifting to small and medium/large wide-body airplanes, like the 787 and 777X, the primary demand for very large airplanes going forward will be in the cargo market,” according to Boeing. It projects a 20-year need for 920 new wide-body freighters over the forecast period.

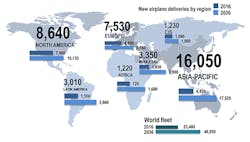

Not surprisingly, Boeing picks the Asian regional market, including China, to continue lead global demand for total airplane deliveries over the next 20 years. Worldwide, 57% of all new deliveries will support airlines’ expansion plans, while 43% will address replacement requirements (e.g., more fuel-efficient jets supplanting older models.)

In the regional forecasts, Asia (including China) is forecast to require 16,050 new aircraft over 20 years, while the second-most “demanding” region will be North America, where total demand for 8,640 new jets is forecast. The European market will require 7,530 new jets, followed by the Middle Eastern (3,350 new aircraft) and Latin American (3,010 new aircraft) regions.