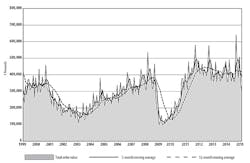

Domestic manufacturers, including machine shops, ordered $304.74 million worth of metal cutting and metal forming/fabricating equipment during February, 10.6% less than during January and 14.6% less than during February 2014. The second-consecutive monthly drop is also the fourth month in the past five to show a decline in the U.S. Manufacturing Technology Orders report, the exception being the late-year surge recorded in December 2014.

After two months, U.S. manufacturers have ordered $645.76 million, 9.8% less than they ordered during the comparable period of 2014.

Because of their critical role in manufacturing engineered components of industrial products, orders of machine tools represent a significant indicator of future manufacturing trends. The USMTO is issued monthly by AMT – the Association for Manufacturing Technology, which tracks new orders for machine tools and related technology based on actual data reported by participating manufacturers and distributors. It covers both domestically sourced and imported metal-cutting equipment and metal-forming and -fabricating equipment.

“U.S. manufacturing is facing some pressure in terms of a stronger dollar and lower capital expenditures from the energy industry, but in taking the long view, we’re still in a good position overall,” commented AMT president Douglas K. Woods.

“The automotive and aerospace industries continue to be strong performers, and a number of international manufacturers are making significant investments in U.S. production facilities,” Woods continued. “We project that manufacturing technology orders will gain momentum as we move through the second quarter.”

In addition to the national data reported in the USMTO, the monthly summary includes data on new orders for metal-cutting and metal-forming/fabricating equipment in six regions of the U.S. However, because AMT revised its geographic references in 2014, the association notes that some comparisons for Metal Forming and Fabricating equipment orders are not an accurate reflection of the current data. AMT also notes that the report’s data is adjusted to reflect this change, but some categories remain unreported.

In the Northeast region, February 2015 new metal-cutting machinery orders totaled $83.71 million, declining 30.6% from January and 6.0% from February 2014. The year-to-date total for new orders in the region is $141.82 million, which is a 10.5% improvement over the January-February 2014 period.

In the Southeast, new orders for metal-cutting machinery rose to $29.8 million during February, up 18.0% from January and up 1.2% from February 2014. The region’s year-to-date total is $55.05 million, down 15.1% compared to the two-month total for 2014.

The North Central-East region reported total new orders of $70.8 million for February, down 23.2% from January’s total and down 15.2% from the February 2014 total. For the January-February 2015 period, the region had new orders totaling $162.99 million, which is 3.3% less than during the comparable year-earlier period.

The North Central-West region reported $77.07 million worth of new orders during February, up 34.5% from January, and also up 34.5% from February 2014. The region’s year-to-date new orders totaled $134.4 million, which is a 26.5% increase over the same two-month period of 2014.

The South Central region’s February new orders for metal-cutting machinery were worth $26.95 million, declining slightly (-0.9%) from the January result but down 58.8% from the February 2014 report. The January-February total for the region stands at $54.15 million, or 51.1% less than the result for the same period of last year.

The last of the six regions, the West, reported metal-cutting machine orders of $38.15 million during February, down 23.4% from January and down 30.3% from February 2014. The result brings the West region’s year-to-date total to $87.95 million, which is a decline of 31.1% from the comparable two-month period of 2014.