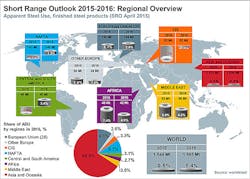

The World Steel Association issued a new short-range outlook for steel consumption, anticipating an increase of just 0.5% this year over 2014. That would mean total global steel consumption of 1.54 billion metric tons during the current year. For 2016, the Association forecasts global steel consumption rising another 1.4%, totaling 1.565 billion metric tons.

World Steel Assn. is a trade group comprised of steelmakers in 65 countries, which tracks global steel production and consumption trends, and issues monthly reports on production and capacity utilization.

In its previous short-range forecast, issued in October 2014, the Association forecast a falling rate of expansion in global steel consumption, and projected a 2.0% increase consumption for 2015 versus 2014.

Hans Jürgen Kerkhoff, chairman of the World Steel Economics Committee said: “We are releasing a restrained growth outlook for the global steel industry mainly due to the deceleration in China. The outlook also reflects the influence of major structural adjustments in most economies, particularly owing to limited investment growth post 2008.”

China is the world’s largest steel-producing nation, typically producing about 50% of the world’s total steel output in any given month. However, having installed millions of tons of new steelmaking capacity over the past two decades, the country has been engaged in an extensive effort to consolidate operations and retire outdated capacity.

The Association noted that Chinese steel demand declined in 2014 for the first time since 1995, adding that is likely to continue for the short term, and that Chinese steel use will continue to decline at a rate -0.5% in 2015 and 2016. Chinese government efforts to stabilize the economy’s decelerating growth are having an uncertain effect, according to the forecasting committee.

The committee also said falling oil prices are affecting steel consumption, reducing demand for new steel infrastructure investments, but also promoting business and consumer activity in oil importing countries. “As economies adjust to lower oil prices, it may lead to reduced demand for steel in some economies in the short term, but should support economic growth and demand for steel in the medium term,” the forecast observed.

Overall, the committee anticipated that steel demand in the developed would moderate in 2015, due to an evening off from increases in 2014 but also to less favorable steel markets in the U.S., Japan, and South Korea.

“The recovery in the EU, although becoming regionally broader based, is still constrained by weak investment activity and high unemployment,” the committee noted. “Steel demand in the developed economies will grow by 0.2% in 2015 and by 1.8% in 2016.”

In the developing world (excluding China), the committee said growth would continued to be “generally weak” in 2015, though it anticipated some positive development in India, Indonesia, Vietnam, and Egypt, “where steel markets are still developing. Steel demand is expected to grow by 4.0% in 2016 after growing by 2.4% in 2015,” according to the report.

Kerkhoff noted that, although “the steel industry will experience a slower pace of growth (in 2015), it will focus on operational efficiencies, and on the value that steel products generate for customers and society.”