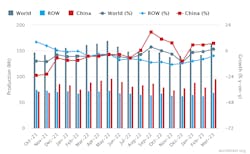

Global raw steel production rose to 165.1 million metric tons during March,13.7% higher than in February and 1.7% more than the March 2022 level. The report, issued by the World Steel Assn. and representing data from 63 countries – with about 97.0% of global steelmaking capacity – shows an industry that has stabilized over recent months, but one that apparently is still affected by weak industrial demand.

Through the first three months of 2023, raw-steel output stands now at 459.3 million metric tons, effectively unchanged (-0.1%) from the March 2022 result.

The current data shows how Chinese producers have restored normal production following pandemic restrictions there, but that the rest of the world is underperforming as industrial demand and construction activity remain tepid in the face of high interest rates and other inhibiting factors.

World Steel’s monthly summary covers the total of carbon steel produced in basic-oxygen or electric arc furnaces and cast into semi-finished forms like billets for bar and rod products; slabs for flat products; or blooms, for beam and pipe products. Specialty and stainless steel volumes are not included in the report.

Recently World Steel issued a short-term forecast for steel demand, predicting a 2.3% year-over-year rise for 2023 to 1.82 billion metric tons, and then by 1.7% to 1.85 billion metric tons for 2024. The new report increases expectations slightly from the forecast issued last October, but the trade association cautioned that high interest rates will continue to restrain steel demand.The new monthly data shows a steady improvement in output by the two largest steelmaking nations – China and India – while tonnages continues to fall in other major centers.

Chinese steelmakers produced 95.7 million metric tons of raw steel during March – well more than half of all the steel produced globally – and 6.9% more than China’s March 2022 result. Through March, China’s year-to-date output total is now 261.6 million metric tons, 6.1% higher than the January-March 2022 result.

While the Indian steel industry does not match the extraordinary volumes produced in China, its members’ March total of 11.4 million metric tons is a 2.7% increase over March 2022, and it brings the YTD total to 33.2 million metric tons, 3.0% higher than the three-month total for last year.

Japanese producers’ 7.5 million metric tons total for March is a -5.9% cut from the March 2022 result, and brings their current-year output total to 21.6 million metric tons, a decrease of -6.0% versus 2022.

The U.S. steel industry’s March output was 6.7 million metric tons (7.4 million short tons), up 10.4% from the February total, but -5.9% lower than the March 2022 result. Through the first three months of 2023, U.S. steelmakers have produced 19.4 million metric tons (21.4 million short tons), -4.0% less than their comparable output during January-March 2022.

The estimated output by Russian steelmakers during March was 6.6 million metric tons, barely higher (+0.4%) than the March 2022 result, but bringing the YTD output to 18.7 million metric tons, a -1.3% decrease from last year’s three-month total.