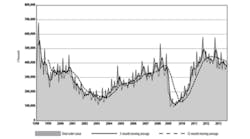

U.S. machine shops and other manufacturers cut their new equipment orders by 25.2% in January, falling to $360.31 million million for the month, versus the revised total of $488.34 million for December. The new result however improved 1.3% on the January 2013 result, $360.31 million.

The new results are included in the monthly U.S. Manufacturing Technology Orders report, issued by AMT - The Association For Manufacturing Technology, which compiles data on nationwide and regional orders data for domestic and imported machine tools and related equipment.

“While monthly order totals are down from December, January is always a soft month and more so this year due to an unusually harsh winter,” observed AMT president Douglas K. Woods. “Overall the news for manufacturing remains positive, with an improving housing market and strong indicators for near-term capital investment.

“We are still optimistic for a strong 2014 and 2015 for manufacturing technology orders, especially as we move through an IMTS year,” Woods emphasized.

The biennial IMTS event may be expected to guide machine shops’ capital spending plans. During the last staging in September 2012, the USMTO report rose 40.7% for the month to $667.47 million, which remains the recent high point in monthly machine tool orders.

AMT tracks orders for metal cutting equipment separately from metal forming and fabricating equipment, with the combined figure representing the monthly total.

The data in the USMTO report are based on the totals of actual data reported by companies participating in the USMTO program.

Regional Imbalances

However, due to changes in survey participants the year-over-year comparison for metal forming and fabricating is not an accurate reflection of the data for some of the six regions covered by the report. The overall report is adjusted to take the change into consideration, though actual data is not available in some sections.

The Northeast region is one of the three for which reporting is inconsistent. The results show orders for metal cutting equipment totaled $52.07 million during January, down 16.7% from the previous month, but 7.9% higher than the regional result for January 2013.

In the Southeast, manufacturers ordered $37.36 million, worth of new machining equipment, down from the December total by 17.8%, up 8.9% when compared with the January 2013 total.

The North Central-East region reported January manufacturing technology orders totaling $92.84 million, a 32.3% drop from December, and a 9.5% decline from the January 2013 order total.

The North Central-West region returned new orders totaling metal cutting equipment orders of $54.61 million, a drop of 43.7% from December and 18.0% from January 2013.

The South Central region had metal cutting equipment orders of $51.46 million for January, down 29.6% from December and down 24.6% from January 2013.

Finally, in the West region, new metal cutting machine orders were up 11.2% from December, to $74.59 million. That result was 96.9% higher than the January 2013 total.