The machine shop at Feintool USA Corp. is captive.

It is an essential part of the company’s integrated operations and makes all of the progressive dies that the fineblanking operations need.

However, just because it is a captive operation and has an assured market for its work, doesn’t prevent the shop from adapting new technologies. It has to.

The company is in one of the most competitive markets, and its shop has to stay ahead of its competition.

|

Feintool USA gets 95 percent of its sales from the automotive industry and, contrary to most other companies’ experience in that market, Feintool USA is growing.

Feintool USA is a Swiss-owned company that has been producing fineblanked parts for the automotive industry in Cincinnati for 30 years. The company is a leader in fineblanking, a metal stamping process that uses progressive dies to turn out a wide variety of parts, including parts for seating, transmissions and safety and security devices for the auto industry and medical components. Its parent company makes similar parts for the European auto markets, and a sister company does similar work in Japan.

Feintool USA counts as its customers General Motors Corp., Ford Motor Co., Chrysler LLC, Toyota America and Honda Motor Manufacturing USA. It competes — and wins contracts away from — units of Toyota and Honda because it has developed niche technologies in fineblanking that put its products ahead.

“Our success comes primarily from the fact that we consider ourselves to be a technology company, not a metalformer,” Ralph Hardt, president of Feintool USA, said. Hardt also is the 2008 chairman of the Precision Metalforming Association.

“We develop and build all of our own tooling, allowing us to start new products from day one, and helping us to develop new applications for fineblanking technology. To drive costs out of a new part, as well as ensure high quality, you need to design for those parameters up front. You can’t do that for your customers unless you have skilled engineering, prototyping and tooling resources,” Hardt said.

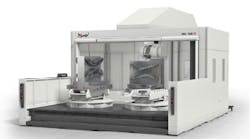

The tooling resources comprise the company’s machine shop, where three wire EDMs, a sinker EDM, three CNC mills, three toolmaker lathes, two vertical drill presses, five Herrig grinders and a jig grinder work on three shifts to turn purchased die sets into the progressive dies that the company requires. The shop does its own CNC programming in-house on MasterCAM software.

During a visit in early October, the shop was making room for a Makino V33i CNC mill that it expected to have installed by early November to do hardmilling, a machining process it hasn’t used before, that it expects will reduce the time it now spends on sinker EDM work and speed up its production.

“We keep tolerances of ± 25 microns” in tool steel, Tim Runyan, toolroom manager for Feintool USA, said.

“We build 100 percent of our tooling, and the tools we use are complex. We have a very tight niche. We deal in high tolerances, and produce safety-critical parts. The shop that is the best at what it does will make it,” Runyan said.

“We will always build our own tooling. It keeps us technically competent. Companies that give up on building their own tooling or doing their own machining give up their own technical performance,” Runyan said.

The biggest challenge that Feintool USA’s shop faces is delivering its products — the tools that the company’s stamping operations require — on time. Working with customers from prototypes to finished goods helps the shop to gain an edge in producing the tools on time, and adopting new tooling and new processing technologies to machine the tool steels that it typically works with, also has contributed to its competitive edge.

Runyan said the shop has cut its expected delivery time on tools to an average of six weeks from an average of 18 weeks to 24 weeks in the past three years.