"Business in the oil industry is busier now than it has ever been," said Joe Rovig, houston-based National Oil Varco group vice-president for repair products and services. "Parts of our business have doubled, tripled and quadrupled in sales volume over the last few years. It started around the beginning of 2005 and now our growing backlog is already out to 2009 and putting pressure on our own machining capacity as well as our outsourcing." Rovig's company makes everything for drilling rigs, including the rigs themselves.

"Our oil industry business has tripled since 2004," said Jim Carlson, president of Carlson Company, a job shop in Tulsa, OK. "We also do work for the power generation industry – natural gas and coal-fired plants – but the biggest demand has been for parts for drilling rigs. We make flanges and ship them to fabricators that supply drilling rigs and refineries.

One of the best indicators of economic activity in the oil industry is the number of wells drilled each year. According to the American Petroleum institute (API), oil and gas drilling in the united states hit a 21-year high in 2006. API estimates that 49,375 oil wells, natural gas wells and dry holes were completed in 2006. the 29,356 natural gas wells completed in 2006 is an all-time record.

The current boom in the oil Patch, the informal name for the petroleum and natural gas industry, is being fueled by the high prices for crude oil.

Oil fields in the United States are much more expensive and difficult to drill – the fields are deeper, the geology is more complex the formations are tighter and they usually require more complex and costly drilling techniques to tap into. As long as the price for a barrel of crude stays high, companies can afford to invest in new and refurbished drilling rigs.

Original estimates for how long this current boom would last were two to three years. Current estimates range from five to seven years or more.

For an oil company to remain in business it has to find or acquire at least as much oil reserves as it is currently pumping out of the ground. that is getting harder and more expensive to do. The average size of new oil discoveries has dropped from 353 million barrels in the 1970s to 107 million barrels since 2000 according to Morgan Stanley investments.

"The law of diminishing returns is alive and well. We're drilling more to get the same volumes," Arthur L. Smith, chief executive officer of John S. Herold Inc., a Norwalk, Conn. energy consulting firm, said.

Royal Dutch/Shell Group has only been able to acquire reserves of between 44 percent and 57 percent of oil and gas it has sold over the last five years. Shell's 2004 production was actually 3 percent less than its 2003 production. At the same time that oil and gas are getting harder and more costly to find, increasing demand from the fastgrowing Chinese and indian economies keeps price pressure up for what oil is currently available. Taken altogether, the current boom is likely to last from now until the oil finally runs out.

Drilling rigs have a long life and go through multiple repair cycles. Many of the parts in pumps and other drilling equipment are designed with the ability to be welded with inlays, machined back to the original specifications, redressed with bearings and seals and then sent back into production. This makes for a strong service business, but national oil Varco and other suppliers are seeing the demand for new equipment outstrip their repair business.

"There are three major sectors in our business: land drilling rigs, deep water floating rigs and jack-up rigs for shallow waters," Rovig said.

"In the past those three sectors had different boom and bust cycles, but this is the first time that we have had all three sectors busy at the same time. our industry is reinvesting in its assets so that it can take advantage of the higher oil and gas prices."

To meet this demand national oil Varco is looking to bring in new suppliers for outsourcing and to purchase additional assets to increase its own machining capacity. Along with equipment is the need for skilled labor.

"We may have to double or triple our current workforce," Rovig added.

" We hire people skilled in our industry, but also go to technical institutes and the military looking for people with skills that just need to be polished. We are currently meeting our needs but it is getting harder. We are not the only ones looking in that marketplace and we may have already exhausted the current labor supply."

"We've maybe doubled our workforce since 2004," Carlson said. "We haven't had much trouble finding people yet. We find it easiest to bring people in off the street and train them. People with good mechanical skills. We just moved in to a new 45,000 sq. ft. shop and that attracts people."

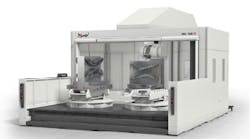

Carlson Company, like National Oil Varco, uses big machines to make big parts.

"It's not unusual for us to take a 3,000 lb. casting and machine 1,500 lbs. off it," Carlson added. "We've worked on single pieces that started out weighing 35,000 lbs. to 40,000 lbs. and we know there are some jobs out there that start weighing 50,000 lbs." Carlson uses five Giddings & Lewis machines for much of its precision machining. the two newest Giddings & Lewis machines have 8-foot tables, one with a live spindle. They do rough shaping on older manual machines and then do the finished precision work on the Giddings & Lewis machines.

National Oil Varco uses a combination of Giddings & Lewis and Mazak machines. they chose those machines because they meet the basic needs of machining for the oil industry: the ability to remove a lot of metal quickly; the ability to do turning, boring, drilling, tapping and milling on multiple faces; the ability to machine a wide range of materials including exotic alloys such as iconel; the ability to do it all with minimum setups and part handling; and the ability to work on LARGE parts.

As long as the price of oil remains high there will be a high demand for new and refurbished drilling rigs. After the bust years of the 1990s most suppliers to the oil industry are being pushed to upgrade and increase their capacity, and taking a page from the automotive and aerospace industries, those suppliers are also looking for reliable suppliers to outsource some of the work to. since market and natural forces are conspiring to keep the price of oil high well into the future, this may be the best time for job shops used to working on large parts to pour some of that high-priced black gold into their own coffers.