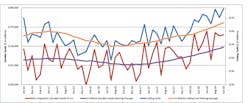

U.S. manufacturers purchased $223.46 million worth of cutting tools during October 2018, according to the monthly Cutting Tool Market Report. That total represents a 6.1% increase from September and a 12.9% increase from October 2017. The CTMR presents cutting-tool consumption as an index to overall manufacturing activity, on the premise that cutting tools are the primary consumable product in the manufacturing sector.

“October results continue the trend we have seen all year. There are some monthly fluctuations but the year-over-year and year-to-date (results) remain over 12% ahead of last year,” commented U.S. Cutting Tool Institute (USCTI) president Phil Kurtz. "The market buzz continues to be positive and it appears 2018 will be the best year in over six years.”

Through 10 months of activity, U.S. manufacturers have consumed $2.07 billion worth of cutting tools, a 12.8% rise over the January-October 2017 total.

The CTMR is compiled and presented by USCTI and AMT – the Assn for Manufacturing Technology, based on actual results reported by participating companies that represent the majority of the U.S. market for cutting tools.

The cutting-tool consumption index contrasts with the U.S. Manufacturing Technology Orders index, which forecasts future manufacturing activity based on the capital investments of manufacturers and machine shops. The most recent USMTO report found domestic manufacturers’ machine-tool October new orders declined -23.3% from the September, but remain 2.1% higher than the October 2017 total. The German Machine Tool Builders Assn. also reported recently that machine-tool purchases declined during Q3 2018, due to a slowing global economy resulting from trade conflicts, increasing protectionism, rising oil prices, high inflation in various emerging markets, and unchecked debt.

As for cutting-tool consumption trends, the report’s sponsors pointed to analysis by forecaster Scott Hazelton of IHS Markit: “Higher oil prices, fiscal stimulus, particularly for investment goods, and consumer demand for durable goods will make 2018 a strong year for manufacturing in general, and cutting tools in particular. Business confidence ebbed towards the end of 2018, with uncertainty over trade and the duration of strong economic growth increasing."

He continued: " Combined with a declining tailwind from tax reform, and increasing wages in a tight labor market, we expect some slowing of manufacturing growth next year, with cutting-tool demand growth likely downshifting from over 13% in 2018 to just under 7% in 2019."