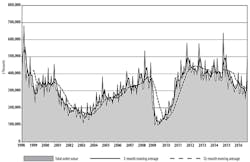

U.S. manufacturers’ new orders for machine tools surged 56% from August to September, and 52% over the September 2015 result, totaling $497.25 million for the month. It was the second consecutive month of rising orders, following a surprising improvement in the August results. AMT – the Association for Manufacturing Technology reports the totals in its monthly U.S. Machine Tool Orders Report.

The USMTO report summarizes actual totals for machine tools, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment. AMT describes USMTO data as a reliable leading economic indicator, as manufacturing companies invest in capital equipment to increase capacity and improve productivity.

The September result demonstrates “the IMTS effect,” the association explained, because the figures include totals recorded by exhibitors at the biannual International Machine Tool Show, which took place September 12-17.

“This year’s uptick in orders indicates manufacturers are eager to see and confident enough to invest in the latest manufacturing technology to improve their operations and products, but the momentum will slow heading into 2017,” commented AMT president Douglas K. Woods.

New orders for machine tools have been lackluster for much of the two years between IMTS 2014 and IMTS 2016, and the September increase was not unexpected. For the current year-to-date, U.S. new orders for machine tools have declined 6.4% versus 2015, totaling $2.91 billion. After first forecasting a late-year rise in new orders, AMT in June revised that outlook and now maintains that current market forecasts indicate total new orders for 2016 will finish lower than 2015.

AMT’s current position is that a manufacturing sector recovery is not expected until the second half of 2017.

As for the September results, AMT noted that major manufacturing sectors “realized dramatic increases in order levels in September, according to the report, except the auto industry. This supports news that the strongest market over the past 20-month downturn has hit the pause button due to a shift in consumer demand from cars to trucks.”

“Overall, the year is expected to finish down about 8%,” according to Pat McGibbon, AMT vice president of Strategic Analytics. “We won’t see the December surge we usually see when manufacturers rush to take advantage of expiring tax incentives because they were extended or made permanent in 2015.”

In the USMTO’s September regional results, new orders for metal-cutting equipment in the Northeast totaled $92.57 million, 67.9% more than during August, and 64.3% more than during September 2015. Through the first nine months of 2016, the Northeast region has recorded $573.4 million in new orders for machine tools, which is 4.9% less than the January-September 2015 total.

In the Southeast region, September new orders for metal-cutting equipment rose 23.4% from August, and 92.3% from September 205, totaling $80.36 million for the month. For the year-to-date, the region has booked new orders totaling $420.51 million, up 28.2% versus nine months of 2015.

The North Central-East region’s September total manufacturing technology new orders showed a 53.5% increase over August and an 18.4% increase over September 2015, finishing the month at $121.31 million. With that, the region’s nine-month new order total for 2016 is $717.4 million — a 17.2% decline versus the January-September 2015 total.

In the North Central-West, new orders for metal-cutting equipment during September totaled $81.1 million, up 54.0% from August and up 36.9% from September 2015. Total manufacturing technology orders in the region through nine months of 2016 stand at $535.4 million, a decline of 9.5% versus the comparable total for 2015.

The South Central region reported $21.0 million worth of new orders for metal-cutting equipment during September, 14.6% more than during August and 60.6% more than during September 2015. The year-to-date total for manufacturing technology new orders in the South Central region is $172.53 million, or 27.6% less than that region’s January-September 2015 total.

Finally, the West region’s new orders for metal-cutting equipment during September totaled $95.35 million, an increase of 113.3% over the August total, and of 94.4% over the September 2015. Through nine months of 2016, the West region’s total new orders for manufacturing technology stand at $495.22 million, which is just 1.9% higher than the comparable total for 2015.