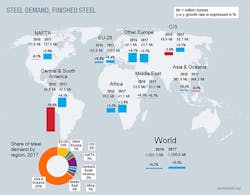

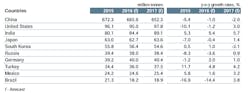

The World Steel Association issued the latest of its semi-annual Short Range Outlook reports, projecting global steel demand for 2016 and 2017. With a slightly more positive position than its April release, World Steel is forecasting that global steel demand will increase by 0.2% to 1.501 billion metric tons in 2016, having declined 3.0% in 2015.

The association represents steel producers in 66 nations, and conducts technical and economic research to promote the

For 2017, World Steel forecasts that global steel demand will grow by 0.5% and will reach 1.51 billion metric tons.

“The steel industry environment remains challenging, with escalated uncertainties driven by geopolitical situations in various parts of the world,” commented T.V. Narendran, chairman of the World Steel Economics Committee. “Recently, the U.K. referendum outcome has further raised uncertainty on the long-awaited recovery of investment in the EU.

"Weakness in investment globally continues to hold back a stronger steel demand recovery,” Narendran continued. “However, a better than expected forecast for China, along with continued growth in emerging economies, will help the global steel industry to move back to a positive growth path for 2016 and onwards. We expect this slight growth momentum to remain weak for the time being due to the continued rebalancing in China and weak recovery in the developed economies.

"Downside risks to this outlook come from the high corporate debt and real-estate market situation in China, Brexit uncertainties and possible further escalation of instability in some regions. On a positive note, steel demand in the emerging and developing economies excluding China is expected to accelerate to show 4.0% growth in 2017 thanks to the resilient emerging Asian countries and stabilization of commodity prices.”

While China has become the most important market for steel demand, investment is less than optimal in many regions of the world, the report noted. In the developed world (mainly, North America and the European Union), private investment remains weak due to “a pessimistic outlook on future demand and other continuing uncertainties,” notwithstanding consistently low interest rates.

Now, governments have only limited monetary and fiscal policy tools remaining to boost investment, and in many emerging and developing economies weak commodity prices, geopolitical tensions, and highly leveraged corporate sectors are dissuading investors in spite of the necessity.

The World Steel outlook finds that Chinese GDP growth in 2016 will be at its lowest level since 1990, and yet with a higher contribution from services and consumption. This may be the result of the Chinese government’s efforts to “rebalance” the economy by increasing infrastructure spending and promoting real estate development and automotive sales.

The result is that the decline in Chinese steel demand for the current year will be less severe than the World Steel April 2016 forecast anticipated, but still is projected to decline by 1.0% in 2016 and by 2.0% in 2017.

Demand for steel in emerging economies has been undermined by low commodity prices and regional conflicts, but the World Steel outlook recognizes some signs of stabilization in this trend. For example, after two consecutive years of double-digit contraction, steel demand in Brazil is seen recovering moderately in 2017.

Also, a “minor rebound” in oil prices has helped to stabilize declines in steel demand in Russia, Mexico, South America, and in certain Middle East economies. However, lower and unstable oil prices and geopolitical instability undermine the outlook for the MENA region.

Overall, steel demand in emerging and developing markets (excluding China) is forecast to expand by 2.0% in 2016 and 4.0% in 2017.

In the world’s developed economies, the forecast is for a moderate recovery in steel demand. EU steel demand remains on track thanks to “resilient consumption” and a mild recovery in construction demand. U.K. steel demand is expected to decline for 2016 and 2017, as an effect of the EU separation, though the forecast finds that the longer-term effects of Brexit are difficult to predict.

The ongoing Middle Eastern refugee crisis is another threat to the EU’s stability, the forecasters find, but the immediate impact on steel demand appears to be minor.

Steel demand in the U.S. is weak due to the strong dollar, which hurts manufacturing investment. The fail in shale-related gas exploration is a further challenging factor. And, Japan’s steel demand growth is weakened by structural issues and currency appreciation.

Steel demand in developed economies is projected to increase by 0.2% in 2016 and by 1.1% in 2017, the forecasters concluded.