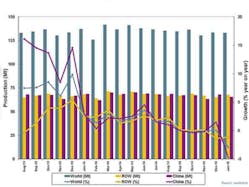

Raw steel production rose less than half a percent from December 2014 to January 2015, totaling 133.7 million metric tons for the month, a result that is 2.9% less than the total for January 2014. The downward trend shows evidence of continued scaling back of raw steel production in China (where government planners have been implementing a strategy of phasing out older, less efficient capacity) — but it also bears out the World Steel Association’s recent mid-range forecast, which last October anticipated that global steel consumption would rise at just 2.0% for 2014 and 2015, a slower rate than in recent years.

In addition to the production decline, World Steel reported that raw-steel capacity utilization was 72.5% during January, down from 72.9% in December, and down from 76.9% during January 2014.

World Steel Assn.’s monthly report tracks raw (or crude) steel tonnage and capacity utilization across 65 countries. Raw steel is the product of basic oxygen furnaces and electric arc furnaces, prior to metallurgical refining and casting into semi-finished products, such as slabs, blooms, or billets. World Steel’s results include data for carbon and carbon alloy steel output. Stainless steels and other specialty alloy steels are not included.

China’s steelmakers, who comprise what is by far the world’s largest steelmaking industry by volume, had 65.5 metric tons, down 4% from December 2014 and down 4.7% compared to January 2014.

In Japan, the world’s second-largest steel-producing nation, raw steel tonnage increased only 0.27% from December, rising to 9.0 metric tons. That result represented a decrease of 4.0% compared to January 2014.

Steelmaking across the Asian region — which includes large-volume producers South Korea, India, and Taiwan, as well as China and Japan — declined 3% from December to January, to 89.4 million metric tons. Compared to January 2014, the region’s decline was 4%.

In the European Union (28 countries), raw steel production rose 28% from December, totaling 14.44 million metric tons, but that figure is down 1% from the January 2014 total.

German steelmakers produced 3.7 million metric tons of raw steel in January, up 13% from December, and up 0.5% compared to January 2014. In Italy raw steel production rose 27% from December to January, to 1.9 million metric tons of raw steel, but declined 11.3% on January 2014.

In France raw steel production rose 17% from December to 1.3 million metric tons, but declined 10.6% compared to January 2014. Spain’s steelmakers increased their output by 39% from December, producing 1.3 metric tons of raw steel, and that result was up 11.8% compared to January 2014.

Turkey’s steelmakers produces 2.6 million metric tons of raw steel during January, which represents a decline of 5% from December and a decline of 10.4% versus January 2014.

The former Soviet Union (C.I.S.) represents a separate region for World Steel statistical reporting, one that increased its total raw steel production total by 1% from December to January. In January 2015, Russian steelmakers produced 6.1 million metric tons of raw steel, up 3% versus December and up 6.0% over January 2014. Ukraine, the other large steelmaking nation in the region, produced 1.9 million metric tons of raw steel during January, down 2% from December and down 25.2% compared to January 2014.

In North America, raw steel production during January was reported at 10 million metric tons, up just 0.2% from December, but down 1% from January 2014 output. U.S. steelmakers’ raw steel output during January was 7.4 million metric tons, down -0.4% from the previous month, but up 0.4% from January 2014.

Finally, in South America, raw steel production across the region increased 8% in January, up 8% from December and up 7% from January 2014. The largest steelmaking nation in the region, Brazil, saw raw steel production increase to 3.0 million metric tons, up 13% from December, and up 7.7% versus the January 2014 total.