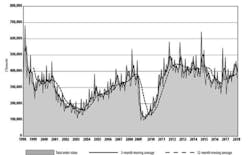

U.S. manufacturers ordered $354.44 million worth of machines for metal cutting and metal-forming and fabricating (known as "manufacturing technology") during February, the second consecutive monthly decline in that index but still a positive sign of overall manufacturing demand. The total is 4.5% less than the January result, but it is 13.8% higher than the February 2017 result.

For the year-to-date, U.S. manufacturers’ new orders total $725.59 million, 27.4% higher than the January-February 2017 total.

These results are contained in the latest release of the U.S. Manufacturing Technology Orders (USMTO) report, a monthly summary of actual totals for machine tool sales, nationwide and within six regions. The report is a product of AMT – the Association for Manufacturing Technology, and the figures are provided to AMT by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

“Our industry’s market is up 27% from 2016 as order growth rates accelerate,” commented Pat McGibbon, AMT’s vice president of Strategic Analytics. “Customers clamor for greater productivity and more capacity, and our member companies push their limits to keep pace with the market’s expansion.”

Looking ahead, however, McGibbon cautioned that “recent trade issues with several of our major trading partners including China, the world’s largest consumer of manufacturing tech, will make harvesting the benefits of this boom market more challenging.”

AMT noted that every region saw significant year-to-date growth rates in the February result. The variation in growth demonstrates the regional manufacturing specialties, and the changes in, for example, oil-and-gas exploration or mining/off-road equipment manufacturing over the past year.

In the Northeast region, new orders for metal-cutting machines rose 18.7% from January to $73.57 million during February, an increase of 11.4% versus February 2017. Through two months of the current year. The region’s new orders for metal-cutting machinery total $135.56 million, a rise of 20.2%.

In the Southeast, total manufacturing technology orders during February amounted to $30.08 million, down 18.6% from January but essentially even (+0.3%) from February 2017. For the year-to-date, Southeast regional manufacturing technology orders total $67.05 million, an improvement of 15.8% over January-February 2017.

February new orders for manufacturing technology in the North Central-East region increased to $83.36 million during February, up 3.8% from January and up 6.3% from February 2017. For the current year, regional new orders are up 16.2% from the first two months of last year.

In the North Central-West, new orders for manufacturing technology totaled $60.17 million during February, down 23.8% from January but up 22.6% from February 2017. The YTD total is $139.08 million, 45.7% higher than last year’s comparable result.

The South-Central region reported new orders for metal-cutting machines at $40.25 million during February, 14.7% lower than January but 41.3% higher than last February’s total. For the January-February period, total manufacturing technology orders in the region are reported at $88.85 million, 75.6% higher than last year’s two-month total.

In the West region, February new orders for metal-cutting machinery slipped to $58.6 million, down 1.8% from January but up 9.4% from February 2017. The January-February 2018 regional total for new orders of metal-cutting machinery is $118.31 million, a 14.5% improvement over the comparable total for 2017.