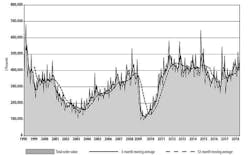

Domestic machine shops and other manufacturers ordered $485 million worth of new machine tools during May 2018, 22.4% more than the April new-order volume and 38.0% more than the order volume for May 2017. The new results bring the current year’s total value for new orders to $2.1 billion, or a 26% increase over the January-May 2017 period.

The data is reported in the latest U.S. Manufacturing Technology Orders Report, released by AMT – the Association for Manufacturing Technology, and based on new machine-tool (manufacturing technology) data supplied by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment. The monthly report includes data for domestically manufactured and imported machinery and equipment, and the results are based on actual order totals, nationwide and in six regional markets.

The May totals continue to illustrate the growth in U.S. manufacturing demand over the past year, and but are encouraging following slowing order volume during April.

“The May rebound was largely expected as April tends to be a slow month,” commented AMT president Douglas K. Woods, "but the 26% jump over 2017 shows the strength in the global markets for manufacturing technology products, and places the trend line on orders above our projections from last year."

The current demand for manufacturing technology is highlighted by automotive industry capital investments, according to AMT. It also called attention to building demand in “engine and turbine” and “power generation” manufacturing.

Woods acknowledged "some turbulence" in industrial markets, citing tariff concerns, supply chain challenges, availability of skilled labor, rising interest rates, and “disruptive technologies shifting markets and methods." He nevertheless asserted that current “market dynamics” will promote continued economic growth.

The only region to report declining demand during May was the Northeast, where new orders for metal-cutting machinery slipped -3.3% from April to $69.24 million. Even so, that signifies a 19.3% increase over the region’s May 2017 total metal-cutting machinery, and raise the year-to-date total 24.1% to $355.32 million.

In the Southeast region, new orders for metal-cutting machinery increased 71.0% from April to $65.89 million, which is an 83.6% rise over last May’s comparable figure. The region’s January-May total for metal-cutting machinery is $230.16 million, a 21.7% improvement for 2018.

May new orders for metal-cutting machinery in the North Central-East region increased to $120.60 million, a rise of 28.0% from April and of 54.2% from May 2017. For the year-to-date, the region’s metal-cutting machinery orders total $392.42 million, or 35.0% higher than last year’s five-month result.

In the North Central-West region, total manufacturing technology orders during May rose 15.3% from April and 7.9% from May 2017, to $90.75 million. For the year-to-date, regional manufacturing-technology new orders are up 40.3% from last year at $415.45 million.

In the South-Central region, new orders for metal cutting machinery rose 64.5% from April and 68.2% from May 2017, to $49.76 million. That bring the current-year total to $222.25 million, or 41.8% higher than last year’s comparable result.

Last, in the West region, new orders for metal-cutting machinery totaled $78.85 million during May, which is 11.5% higher than the April result and 40.6% higher than the May 2017 result. The regional YTD total for metal-cutting machinery orders is $376.82 million, an increase of 19.6% over last year’s January-May order volume.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.