Demand Still Strong for EU Machine Tool Builders

Machine tool builders in Germany and Italy, two of the world’s largest domestic industry groups, reported more growth in orders during the first quarter of 2018. Their results corroborate the strong demand recorded by the U.S. machine tool sector during most of the same period earlier this year.

For the German machine-tool industry, demand for metal-cutting and metal-forming technologies were equally strong during the first quarter of 2018, and capacity utilization ran at 93.4%.

VDW noted its member companies are benefiting from continuing widespread demand across all major consuming sectors, which resulted in record-high production levels (+7%) and new orders during 2017.

During the first quarter of 2018, German machine-tool manufacturers recorded new orders that were 22% higher than during the same period of 2017; domestic orders were up by 39%; foreign orders rose by 15%.

“Our sector is continuing to turn in a highly dynamic performance during 2018,” according to Dr. Wilfried Schäfer, executive director of VDW, the German Machine Tool Builders’ Assn. “Last year’s excellent performance is thus progressing seamlessly,” he added, noting another point of consistency with U.S. machine tool orders.

For the German machine-tool industry, demand for metal-cutting and metal-forming technologies were equally str

VDW noted its member companies are benefiting from continuing widespread demand across all major consuming sectors, which resulted in record-high production levels (+7%) and new orders during 2017.

“Based on a sizeable increase in orders last year, which is set to continue, we see for 2018 as well potential for higher growth in production output than was still being anticipated in February, and are raising our production output forecast from 5% to another 7% growth,” Schäfer said.

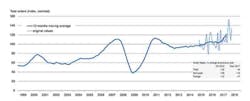

The Italian machine-tool sector presented a more complex view for Q1: overall orders were down 4.3% year-over-year, according UCIMU – Sistemi per Produrre. But, the absolute value of new orders is up to 179.6 (2010 average = 100.) The trade association attributed the decline in orders to weaker demand in the domestic market (-25.8%), which was offset to some extend by a 7.6% increase in order volume from abroad.

“We are not worried about the slowdown in the orders collected in the domestic market,” commented Massimo Carboniero, president of UCIMU. “We expected that. It is the rebound effect of the extraordinary outcome achieved at the end of 2017, when everyone accelerated the race to investments, fearing that the super- and hyper-depreciation incentive measures would not be confirmed.”